States with Most People in Financial Distress Map

Alex Cartwright

Senior Cartographer & GIS Specialist

Alex Cartwright is a renowned cartographer and geographic information systems specialist with over 15 years of experience in spatial analysis and data...

Geographic Analysis

What This Map Shows

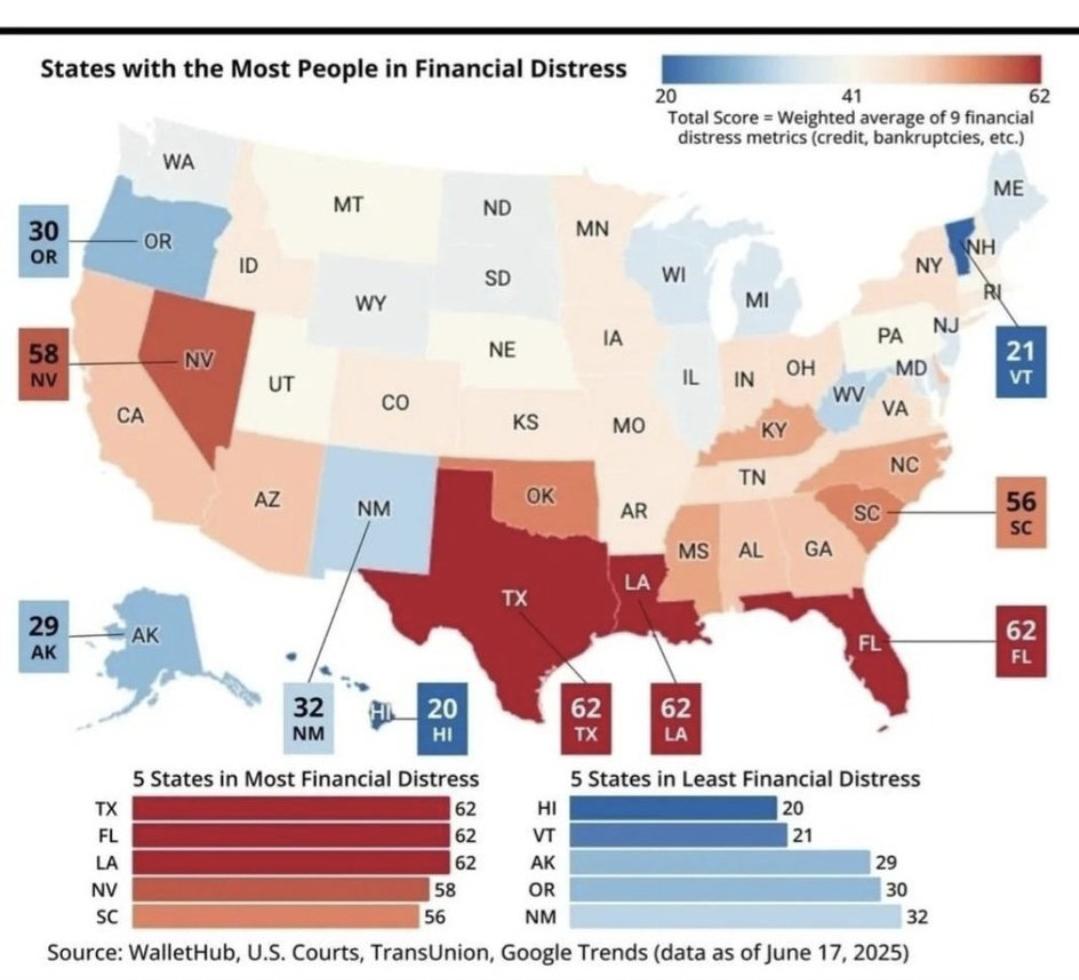

This map illustrates the states with the highest numbers of individuals experiencing financial distress. It highlights the various regions where economic hardship is most pronounced, providing a visual representation of the financial challenges faced by many Americans today. Financial distress can encompass a range of issues, including high levels of debt, inability to meet basic living expenses, and the ongoing struggle to achieve financial stability. Understanding this map is crucial for policymakers, businesses, and nonprofits aiming to address these challenges effectively.

Deep Dive into Financial Distress

Financial distress affects millions of Americans, and its roots are as diverse as the individuals who experience it. The factors contributing to financial distress can include job loss, medical expenses, skyrocketing housing costs, educational debt, and unexpected life events. Interestingly, the economic landscape of a state can significantly impact the prevalence of financial distress among its residents.

For instance, states with high living costs, such as California and New York, often see more individuals struggling financially, even if they have higher average incomes. In contrast, states with lower living costs might have residents who find themselves in financial distress due to lower wages or fewer job opportunities.

Statistics show that approximately 40% of Americans do not have enough savings to cover a $400 emergency expense. This figure is alarming when you consider the potential impact of unexpected costs on a household's financial stability. Furthermore, the COVID-19 pandemic has exacerbated these issues, leading to increased unemployment rates and heightened financial insecurity across the nation.

Interestingly, the demographic factors surrounding financial distress are also noteworthy. Certain populations are disproportionately affected. For example, single-parent households, particularly those led by women, often face higher rates of financial hardship. Racial and ethnic minorities are also more likely to experience financial distress, influenced by systemic inequalities and barriers to economic opportunity.

Moreover, geographical factors play a role in shaping financial health. Urban areas may offer more job opportunities, but they also come with higher living costs, while rural areas might have lower expenses but fewer job prospects. Understanding these dynamics is essential for addressing the root causes of financial distress and implementing effective solutions.

Regional Analysis

When analyzing the map, notable patterns emerge across different regions. For instance, the southeastern United States, including states like Alabama and Mississippi, often ranks high in financial distress measures. These states grapple with high poverty rates, limited access to healthcare, and fewer educational opportunities, all contributing to the financial struggles of their residents.

Conversely, states in the Northeast, such as Massachusetts and Connecticut, may exhibit high financial distress figures despite generally higher income levels. This paradox highlights the significance of local economic conditions, such as housing markets and cost of living. In states like California, high housing costs create a financial burden that overshadows higher salary levels for many residents.

Midwestern states like Ohio and Michigan present mixed results. While some areas struggle with financial distress due to industrial decline and job loss, others are experiencing revitalization and growth, leading to a more stable financial environment. This variability underscores the importance of localized economic strategies tailored to specific community needs.

Significance and Impact

Understanding financial distress is crucial, not just for those directly affected, but for society as a whole. High levels of financial distress can lead to increased reliance on social services, higher crime rates, and lower overall community health. Moreover, it can have a ripple effect on local economies, as individuals struggling financially may reduce their spending, affecting local businesses.

Addressing financial distress requires a multifaceted approach, including improving access to education, healthcare, and job training programs. Interestingly, initiatives aimed at financial literacy can empower individuals to make informed decisions regarding their finances, ultimately helping to alleviate some of the stress associated with financial instability.

As we look to the future, it's essential to monitor trends in financial distress. Economic recovery efforts post-pandemic will play a significant role in shaping the financial landscape of various states. Have you noticed how some regions are bouncing back faster than others? This disparity will likely continue to evolve, making it imperative for stakeholders to remain engaged and proactive in addressing the roots of financial distress across the nation.

Visualization Details

- Published

- October 17, 2025

- Views

- 8

Comments

Loading comments...