Salary Needed to Afford a Home Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

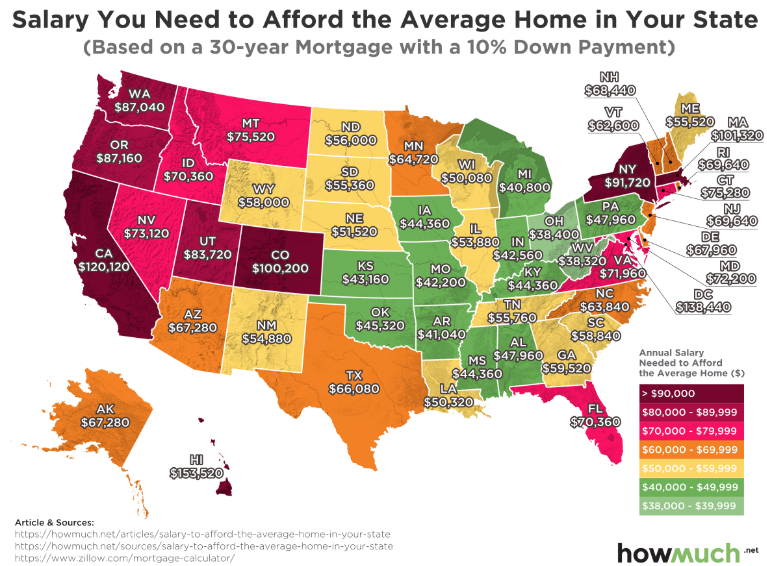

What This Map Shows\nThis map provides a visual representation of the salaries required to afford a home in various regions across the country. By overlaying median home prices with average incomes, it highlights the disparity between what individuals earn and what they need to pay for housing. This information is crucial, especially in today’s housing market, where affordability is a pressing issue for many.

Deep Dive into Housing Affordability\nHousing affordability remains a significant challenge for many families and individuals, often dictating where people choose to live and work. The concept of affordability is typically defined by the 30% rule, which suggests that no more than 30% of a household's income should be spent on housing costs, including mortgage payments or rent. However, in many parts of the country, especially urban areas, this guideline is increasingly becoming a distant reality.

Interestingly, the map illustrates how salaries vary dramatically across different regions, affecting home affordability. For instance, in tech-heavy cities like San Francisco or Seattle, the median home price can soar to over a million dollars. To afford such homes, a household would need an annual salary of approximately $200,000 or more. In contrast, in smaller towns or rural areas, median home prices may be significantly lower, requiring salaries around $50,000 to $70,000 to comfortably afford a home.

Home prices are influenced by various factors, including local economies, employment opportunities, and the availability of housing. For example, cities with booming job markets often see a surge in demand for housing, which can drive prices up. Additionally, the influx of people moving to these areas in search of employment can further exacerbate the situation, leading to a rapid increase in home prices.

Data from the U.S. Census Bureau indicates that as of 2023, the national median home price was approximately $400,000. However, the salaries required to afford homes in high-demand areas are often far out of reach for the average worker, leading to a growing affordability crisis. This crisis not only impacts individual families but also has wider implications for community stability and economic growth. Urban sprawl and increased commuting times are just a few of the side effects of high housing costs pushing people to seek more affordable options far from their workplaces.

Regional Analysis\nWhen looking at regional variations in the map, it's clear that not all areas are created equal. Coastal cities, particularly those on the West Coast, tend to have the highest required salaries for homeownership. For example, in Los Angeles, prospective homeowners need to earn around $120,000 annually to afford a median-priced home, while in New York City, that figure can climb to nearly $150,000. These figures starkly contrast with cities in the Midwest, where places like Indianapolis or Columbus offer homes at much lower prices, requiring salaries that are often half as much.

Moreover, some regions are experiencing rapid shifts in housing demands. Cities like Austin, Texas, have seen an influx of new residents, pushing home prices up significantly. In contrast, areas with declining populations, such as parts of the Rust Belt, often have lower home prices but also suffer from stagnant wages and fewer job opportunities. This juxtaposition highlights the complexities of the housing market and the challenges it presents to both buyers and policymakers.

Significance and Impact\nUnderstanding the salaries needed to afford a home is crucial for several reasons. Firstly, it sheds light on the broader economic health of a region. High housing costs can lead to increased financial strain on families, resulting in higher rates of bankruptcy and homelessness. Moreover, when housing becomes unaffordable, it can deter potential residents, impacting local economies and stunting growth.

Current trends indicate that the gap between wages and housing prices is widening. As inflation continues to rise, many individuals are finding it increasingly difficult to save for a down payment or meet monthly mortgage payments. This disparity raises essential questions about the future of housing policies and the role of government in ensuring that housing remains accessible to all.

Looking ahead, it’s critical for communities to address these challenges proactively. Solutions might include increasing the availability of affordable housing, implementing rent control measures, or enhancing public transportation to improve access to lower-cost areas. As we analyze the data and trends presented in this map, it becomes clear that understanding housing affordability is not just an economic concern; it is a matter of social equity and community well-being.

Visualization Details

- Published

- August 28, 2025

- Views

- 90

Comments

Loading comments...