Map of European Homeownership Rates

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

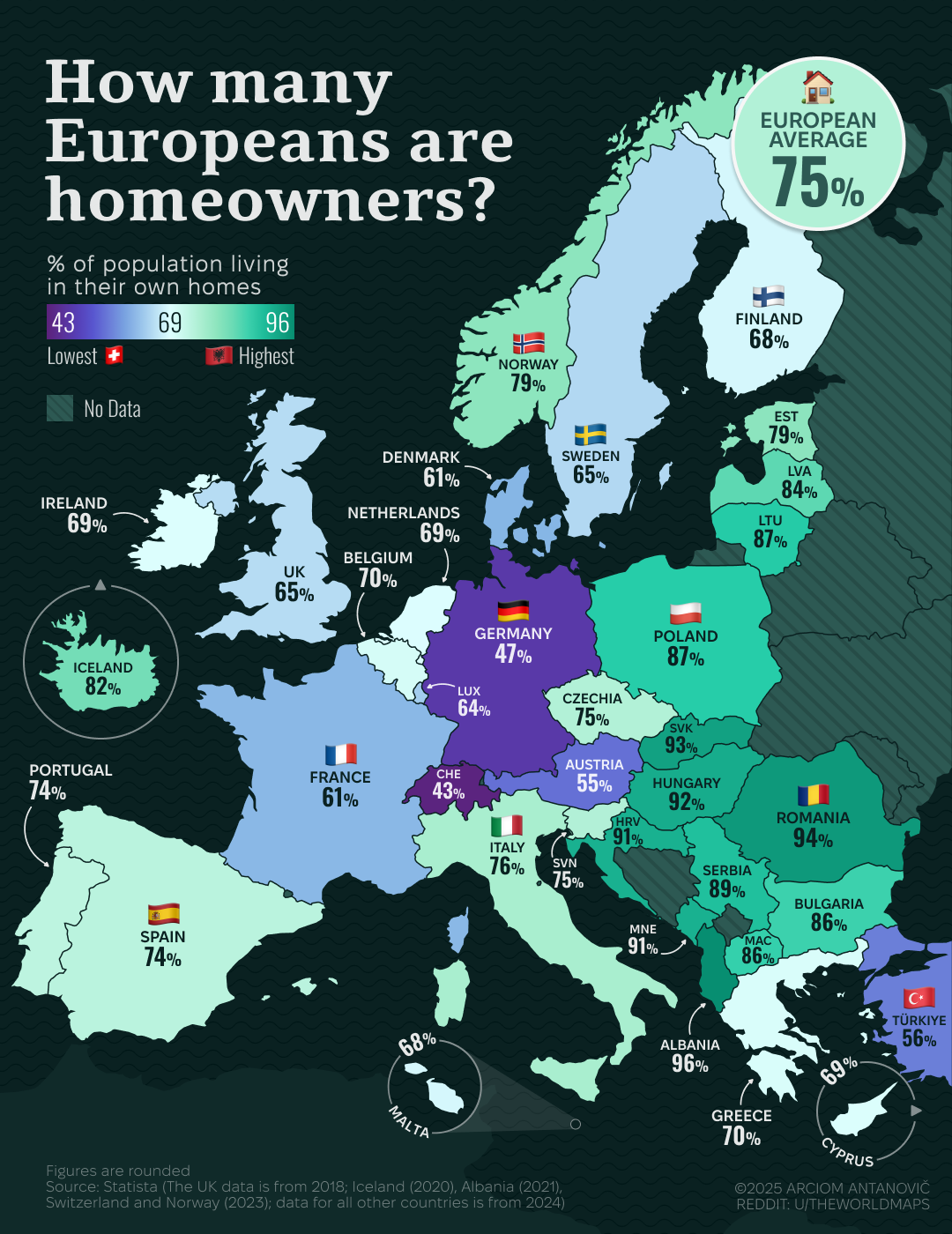

This map illustrates the share of the European population living in their own homes, providing a clear visual representation of homeownership rates across various countries in Europe. Homeownership is a significant aspect of social and economic stability, influencing everything from family dynamics to national economies. It reflects not only personal wealth but also cultural attitudes towards property and investment.

Deep Dive into Homeownership in Europe

Homeownership rates vary widely across Europe, influenced by factors such as economic conditions, housing policies, and cultural values. In countries like Romania and Hungary, ownership rates soar above 90%, indicating a strong preference for owning rather than renting. In contrast, nations such as Germany and Switzerland exhibit significantly lower rates of homeownership, hovering around 50% and 43% respectively.

What's fascinating is that these disparities often correlate with historical and socio-economic contexts. For instance, post-World War II reconstruction in Eastern Europe emphasized homeownership as a means of stability, leading to policies that encouraged citizens to buy their homes. In contrast, Western European countries have often embraced rental markets, providing extensive tenant protections that make renting a viable long-term option.

Moreover, the economic landscape plays a crucial role in shaping homeownership trends. Countries with robust economies tend to have higher homeownership rates, as citizens generally have more disposable income to invest in property. For example, Norway, known for its high standard of living and considerable wealth, boasts a homeownership rate of 82%. Meanwhile, the economic challenges in countries like Greece have led to lower homeownership, with many citizens struggling to afford property amidst financial instability.

Interestingly, the impact of the 2008 financial crisis can still be seen in homeownership rates today. Many European nations experienced a decline in homeownership due to increased unemployment and tighter lending practices. As the economy recovers, we observe a slight resurgence in homeownership, but the pace varies significantly from country to country.

Regional Analysis

When we break down the map regionally, it becomes evident that Northern and Western Europe generally have higher rates of homeownership compared to Southern and Eastern Europe. For example, Scandinavian countries typically see high levels of homeownership, with Sweden recording around 79%. This trend is supported by strong social welfare systems that make homeownership more accessible.

In Southern Europe, the situation is more complex. Countries like Spain and Italy show homeownership rates above 75%, yet these numbers can be misleading. The economic difficulties faced by these nations have led many to question the sustainability of homeownership as a long-term strategy, especially in areas where property values have dropped significantly since the financial crisis.

Eastern Europe presents a unique case. Countries like Poland and the Czech Republic enjoy high homeownership rates, thanks in part to post-communist policies that encouraged private ownership. However, the homeownership landscape is rapidly changing, with younger generations increasingly favoring rental options for flexibility and mobility.

Significance and Impact

Understanding homeownership rates is crucial, as they provide insight into broader economic health and social stability. High homeownership rates often correlate with stronger community ties and a sense of belonging. However, they can also lead to challenges, such as housing market bubbles and increased financial risk for individuals.

In recent years, the conversation around homeownership has shifted. With the rise of remote work and changing lifestyle preferences, younger generations are reevaluating what homeownership means to them. Have you noticed that many young people today prioritize experiences over owning property? This shift may lead to increased rental demand and further impact housing markets across Europe.

As we look to the future, it's essential to monitor trends in homeownership. Factors such as urbanization, the impact of climate change, and evolving economic conditions will undoubtedly shape the landscape of homeownership in Europe. Governments and policymakers must respond to these changes, ensuring that housing remains accessible and sustainable for all citizens, regardless of their location or economic status.

Visualization Details

- Published

- October 12, 2025

- Views

- 50

Comments

Loading comments...