Cost-of-Living Adjusted Median Household Income by State Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

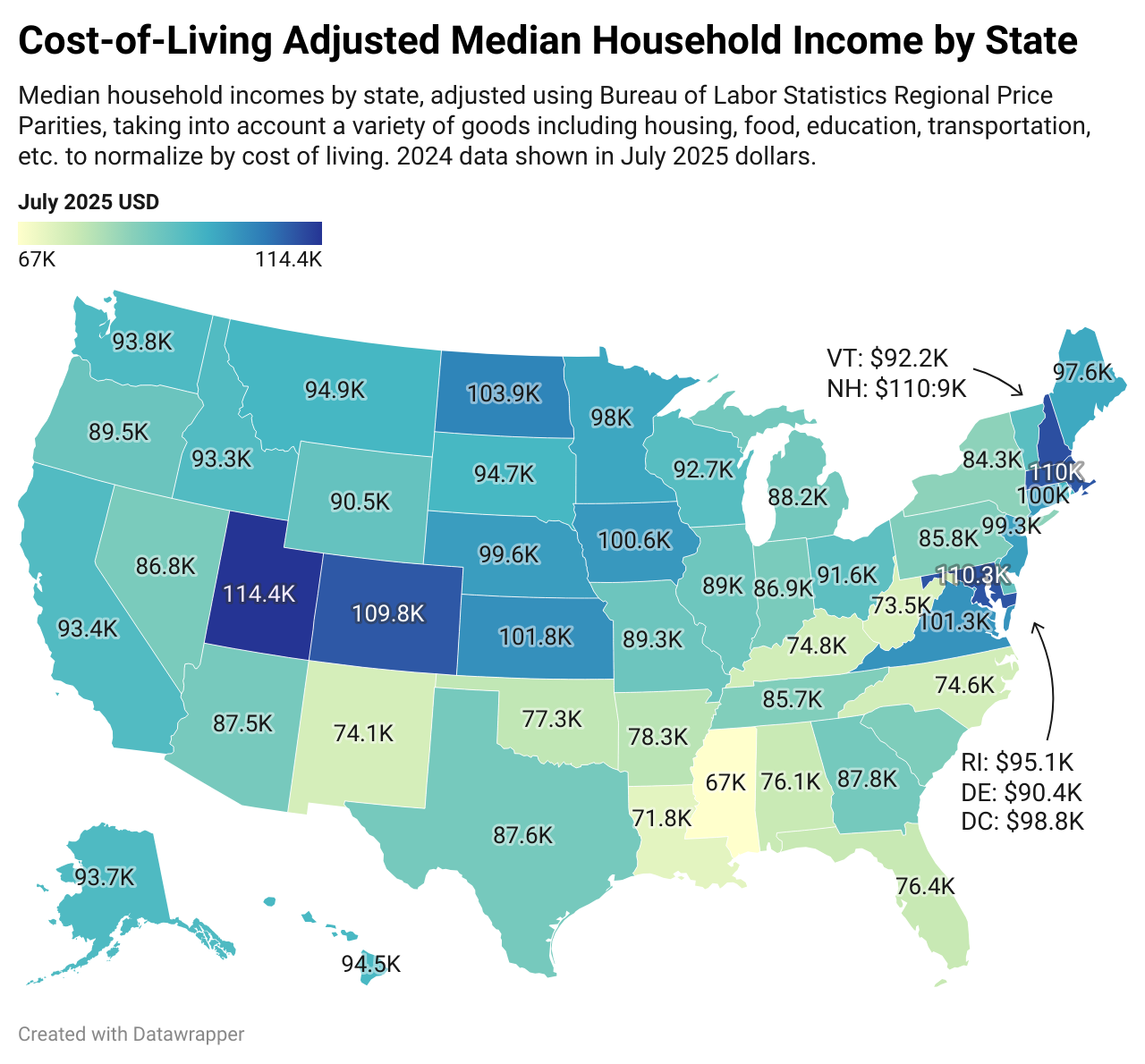

The "Cost-of-Living Adjusted Median Household Income by State Map" provides a comprehensive view of how median household incomes across the United States compare when adjusted for local living costs. This visualization highlights the disparities in economic well-being by illustrating not just the raw income figures but how those incomes translate into purchasing power in different states. As you look at the map, you'll see states where the nominal income might be high, yet the cost of living significantly erodes that advantage. Conversely, some states may show lower median incomes, but when adjusted for living expenses, they offer a more favorable financial environment for residents.

Deep Dive into Cost-of-Living Adjusted Income

Cost-of-living adjustments (COLA) are crucial for understanding economic health beyond just numbers. They take into account factors such as housing prices, utility costs, healthcare, and transportation expenses. For instance, a household earning $70,000 in San Francisco might feel significantly different compared to a household with the same income in rural Arkansas. What's fascinating is that while the income figures can appear favorable in high-cost areas, the reality of purchasing power tells a different story.

In 2024, the national median household income is projected to be around $76,000. However, when adjusted for living costs, states like Mississippi, Arkansas, and West Virginia often rank higher in terms of real income. This is because their lower cost of living allows families to stretch their dollars further. On the other hand, high-income states such as California and New York can see their real income values drop when considering how much it costs to live there.

Interestingly, the differences in COLA-adjusted income reveal much about regional economic health. For example, states in the Midwest, like Ohio and Indiana, often have lower living costs and therefore show a better adjusted income compared to coastal states. This can lead to a scenario where someone in the Midwest feels more financially secure than a counterpart in a high-cost state, despite the latter's higher nominal income.

Regional Analysis

Examining the map reveals significant regional variations that speak volumes about the economic landscape of the U.S. In the Northeast, states like Massachusetts and New York may lead in nominal income, but their high living costs place them lower in adjusted income rankings. In contrast, Southern states such as Alabama and Tennessee, while not leading in raw income, often provide a better quality of life when adjusted for costs.

The West Coast presents a mixed picture. California, with its booming tech industry, shows high nominal incomes, but when adjusted, many areas suffer from exorbitant living costs that diminish real income. Meanwhile, states like Idaho and Utah have become attractive for those seeking a balance between income and cost of living, making them hotspots for migration in recent years.

In the Midwest, states like Michigan and Wisconsin demonstrate that a strong manufacturing base can provide stable incomes, which, when adjusted, can rival those in more populous and expensive areas. It’s intriguing to see how this regional analysis not only highlights income disparities but also affects migration patterns as families seek better opportunities.

Significance and Impact

Understanding the cost-of-living adjusted median household income is essential for policymakers, businesses, and individuals alike. For policymakers, this data can guide decisions on resource allocation and economic development strategies. It sheds light on which regions need more support and where economic growth is genuinely beneficial for residents.

Moreover, for businesses, this information is invaluable in making location decisions. Companies seeking to expand or relocate must weigh these factors to ensure they attract and retain talent in competitive markets. Interestingly, as remote work becomes more prevalent, we might see shifts in where people choose to live based on these adjusted income figures.

From a personal finance perspective, individuals and families can use this data to make informed decisions about where to live and work. Have you noticed that more people are moving to states with a lower cost of living? This trend isn't just about lifestyle; it's fundamentally tied to financial security and the ability to maintain a comfortable standard of living.

As we look ahead, the implications of these trends will continue to unfold. With economic conditions in flux and inflation affecting living costs, monitoring these changes will be critical for understanding the dynamics of income and cost of living across the United States.

By recognizing how adjusted incomes affect quality of life, we can gain deeper insights into the regional economic landscape and the ongoing evolution of American households.

Visualization Details

- Published

- September 11, 2025

- Views

- 132

Comments

Loading comments...