Financial Distress Map of Texas and Florida

Alex Cartwright

Senior Cartographer & GIS Specialist

Alex Cartwright is a renowned cartographer and geographic information systems specialist with over 15 years of experience in spatial analysis and data...

Geographic Analysis

What This Map Shows

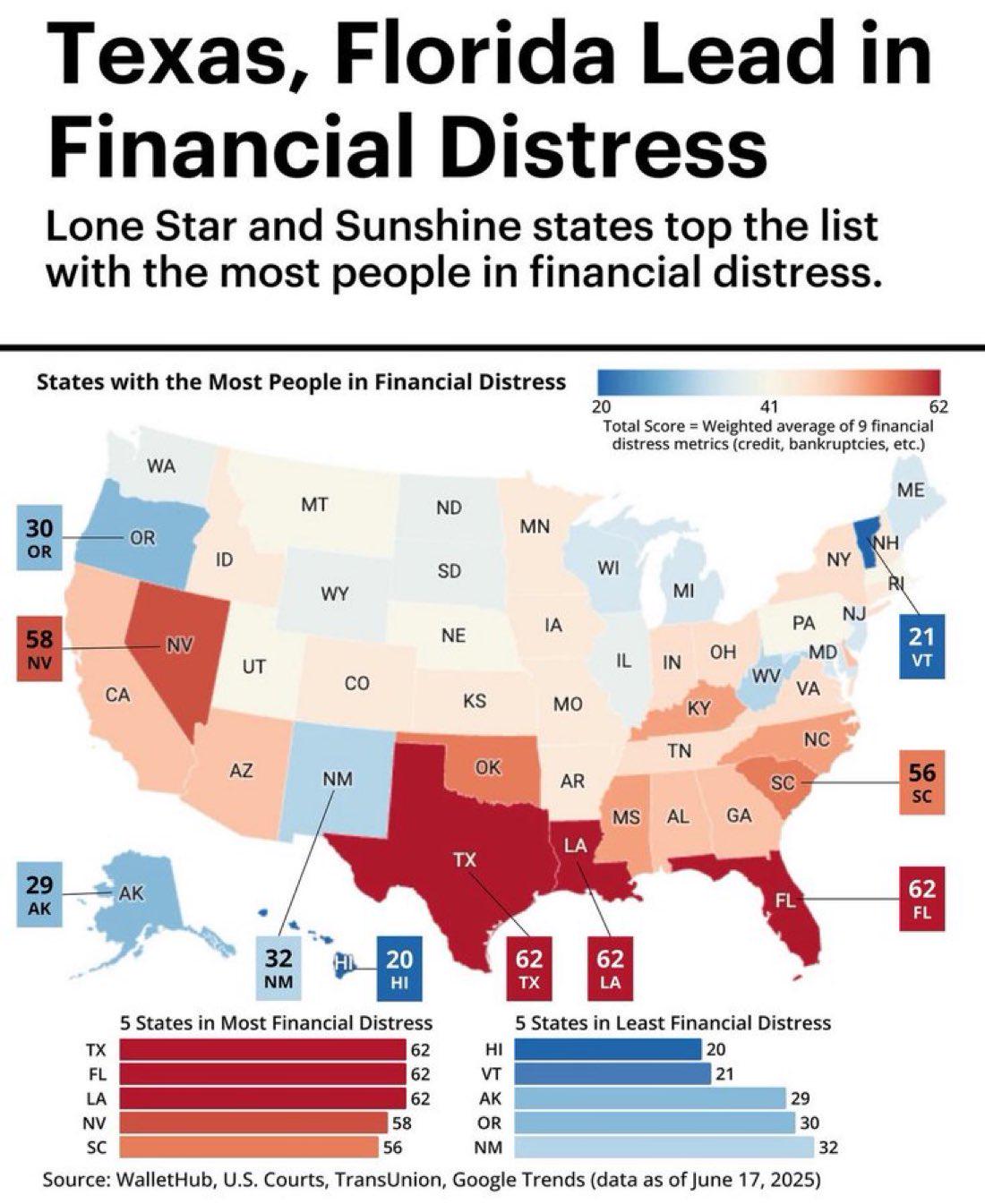

The visualization titled "Texas, Florida Lead in Financial Distress" highlights the financial struggles faced by residents in these two states. It presents data on various financial indicators, such as bankruptcies, delinquencies, and overall economic distress levels. Both Texas and Florida appear prominently on this map, indicating that a significant portion of their populations are grappling with financial hardship. This information is vital for understanding the broader economic landscape in these populous states.

Deep Dive into Financial Distress

Financial distress can be defined as a condition where individuals or households face significant challenges in meeting their financial obligations. This often manifests as inability to pay debts, high levels of credit card delinquency, or even bankruptcy. In Texas and Florida, a combination of factors contributes to this troubling phenomenon.

Interestingly, both states have experienced rapid population growth in recent years, attracting new residents with the promise of job opportunities and a lower cost of living. However, this influx can strain local economies and infrastructure, leading to rising costs in housing, healthcare, and education. As demand increases, so do prices, making it challenging for many to keep up financially.

According to recent statistics, Texas has seen a surge in personal bankruptcies, with a reported 25% increase over the past two years. Factors such as fluctuating oil prices, which significantly impact the Texas economy, play a major role. The energy sector's instability can lead to job losses and wage stagnation, pushing families into financial distress. Additionally, Texas has a high percentage of residents living paycheck to paycheck, meaning that even minor financial setbacks can have devastating effects.

Florida, on the other hand, faces its own unique challenges. The state’s economy relies heavily on tourism, which can be vulnerable to economic downturns and global events, such as the COVID-19 pandemic. During such crises, unemployment rates can skyrocket, leading to increased financial insecurity for many Floridians. Furthermore, Florida’s housing market has seen rapid price increases, making homeownership less attainable for lower and middle-income families. The average rent in cities like Miami and Orlando has reached record highs, leaving many residents struggling to make ends meet.

Remarkably, both states also rank high in the number of residents with student loan debt, which adds another layer to their financial distress. The burden of educational loans often leads to delayed life milestones such as homeownership and retirement savings, contributing to a cycle of economic instability.

Regional Analysis

Looking at the map, we can see that specific regions within Texas and Florida show varying levels of financial distress. In Texas, urban areas like Houston and Dallas experience higher rates of financial strain compared to more rural areas, which might have lower costs of living but also fewer job opportunities. For instance, Houston has one of the highest bankruptcy rates in the state, which is reflective of its cost of living and the economic challenges faced by its residents.

In Florida, regions such as Miami-Dade County stand out with alarming levels of financial distress. This area has been grappling with high unemployment rates and a significant portion of the population living in poverty. In contrast, smaller cities or rural areas in northern Florida tend to have lower levels of financial distress, primarily due to lower housing costs and a more stable job market in industries like agriculture.

Significance and Impact

The implications of financial distress are profound. When large populations face economic hardship, it can lead to increased demand for social services, higher crime rates, and overall lower quality of life. Local governments may struggle to provide necessary resources, leading to a cycle of poverty that is difficult to break.

Current trends indicate that this issue may continue to escalate, especially if economic growth does not keep pace with the rising cost of living. Interestingly, as the economy shifts and industries evolve, it will be crucial for community leaders and policymakers in Texas and Florida to address these challenges proactively. Solutions may include increased access to financial education, better job training programs, and initiatives aimed at affordable housing.

In conclusion, understanding the financial distress highlighted on this map is essential for grasping the broader socio-economic landscape of Texas and Florida. As these states continue to grow and evolve, addressing the financial vulnerabilities of their residents will be critical to ensuring a prosperous future for all.

Visualization Details

- Published

- September 8, 2025

- Views

- 72

Comments

Loading comments...