Healthcare Cost Increase Map Without Tax Subsidies

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

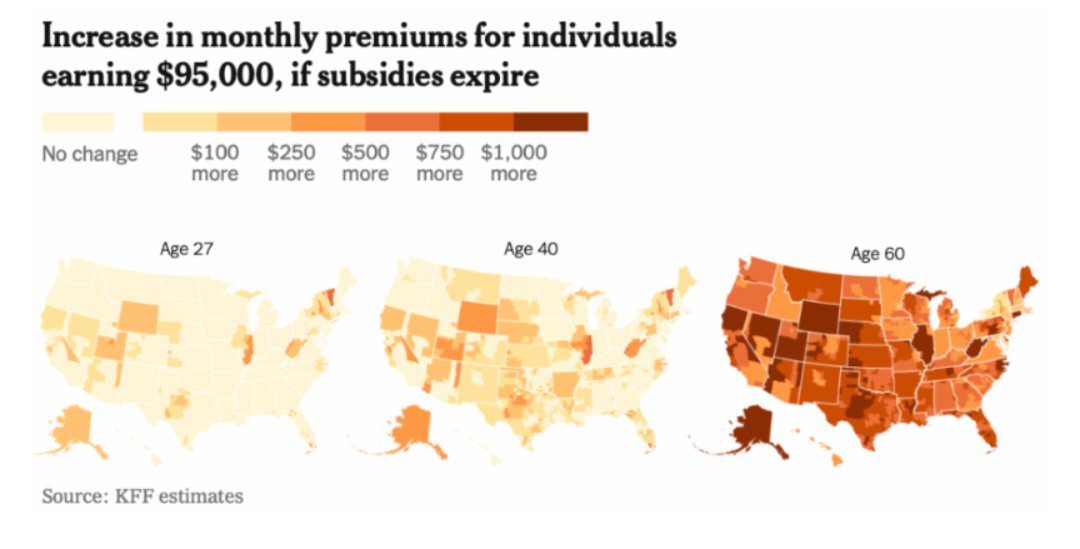

The visualization titled "Increasing Cost of Healthcare if Tax Subsidies Not Extended" illustrates the projected rise in healthcare costs across different regions if current tax subsidies are not maintained. This map provides a stark representation of how financial support impacts healthcare affordability for individuals and families. Beyond its visual appeal, it highlights a critical issue in the ongoing discussions surrounding healthcare policy in the United States.

Deep Dive into Healthcare Costs

Healthcare costs have been a pressing issue for many years, with rising expenses affecting millions of Americans. The primary drivers of these costs include the price of medical services, pharmaceutical costs, and administrative expenses. Interestingly, tax subsidies have played a crucial role in making healthcare more accessible by alleviating some of the financial burden on individuals. When subsidies are extended, they help reduce out-of-pocket costs for health insurance, enabling more individuals to seek necessary medical care.

According to the Kaiser Family Foundation, the average annual premium for employer-sponsored family health coverage reached over $21,000 in 2022, with employees contributing approximately $5,600 toward that total. If tax subsidies are not extended, projections indicate that these costs could soar even higher, pushing healthcare out of reach for many families. The implications of this increase are profound: individuals may delay seeking medical treatment, leading to poorer health outcomes and higher costs in the long run.

Furthermore, the Affordable Care Act (ACA) was designed to make healthcare more affordable for low- to middle-income families through premium tax credits. However, these credits are contingent on the continuation of subsidies, and without them, many could find themselves unable to afford coverage. For example, individuals earning just above the poverty line could see their healthcare costs double or even triple, resulting in a significant increase in the uninsured rate.

A specific concern is the potential rise in emergency room visits, which tend to be more expensive than regular check-ups or preventive care. If individuals forego regular healthcare due to cost, they may face severe health issues that require urgent care, ultimately driving up overall healthcare costs for everyone.

Regional Analysis

Examining the map reveals stark contrasts between different regions. For instance, states with a higher number of low-income residents, such as Mississippi and Arkansas, stand to be impacted the most. In these areas, the lack of extended tax subsidies may lead to a significant increase in the percentage of uninsured individuals, worsening health disparities.

In contrast, states like California and New York, which have more robust healthcare programs and a larger number of residents qualifying for subsidies, may experience less dramatic cost increases. However, even in these states, the absence of subsidies could still lead to notable financial strains on families who already struggle to make ends meet.

Interestingly, rural areas may face unique challenges. These regions often have fewer healthcare providers, meaning that increased costs could further limit access to care. For example, a rural family might already have to travel long distances to see a healthcare provider. If costs rise due to the lack of subsidies, they may opt out of insurance altogether, leading to dire health outcomes.

Significance and Impact

The potential increase in healthcare costs due to the expiration of tax subsidies carries significant implications for public health and the economy. The repercussions extend beyond individual households; they impact the workforce and overall economic productivity. If people cannot afford healthcare, they are less likely to maintain their health, leading to increased absenteeism in the workplace and reduced economic output.

What's fascinating is how this issue intersects with broader societal trends. As healthcare costs rise, so does the conversation around universal healthcare. Many advocates argue that extending subsidies is merely a band-aid solution, while others see it as essential support for millions of Americans. As we look toward the future, the healthcare landscape may continue to evolve, with implications that could resonate for generations.

In conclusion, the map serves as a vital reminder of the interconnectedness of policy decisions and healthcare accessibility. As we navigate these discussions, it's crucial to consider the potential outcomes of not extending tax subsidies, not only for individual families but for society as a whole. The choices made today will shape the future of healthcare in America, and understanding these dynamics is essential for informed advocacy and policy-making.

Visualization Details

- Published

- October 30, 2025

- Views

- 2

Comments

Loading comments...