Income Tax Payment Percentage Map 2024

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

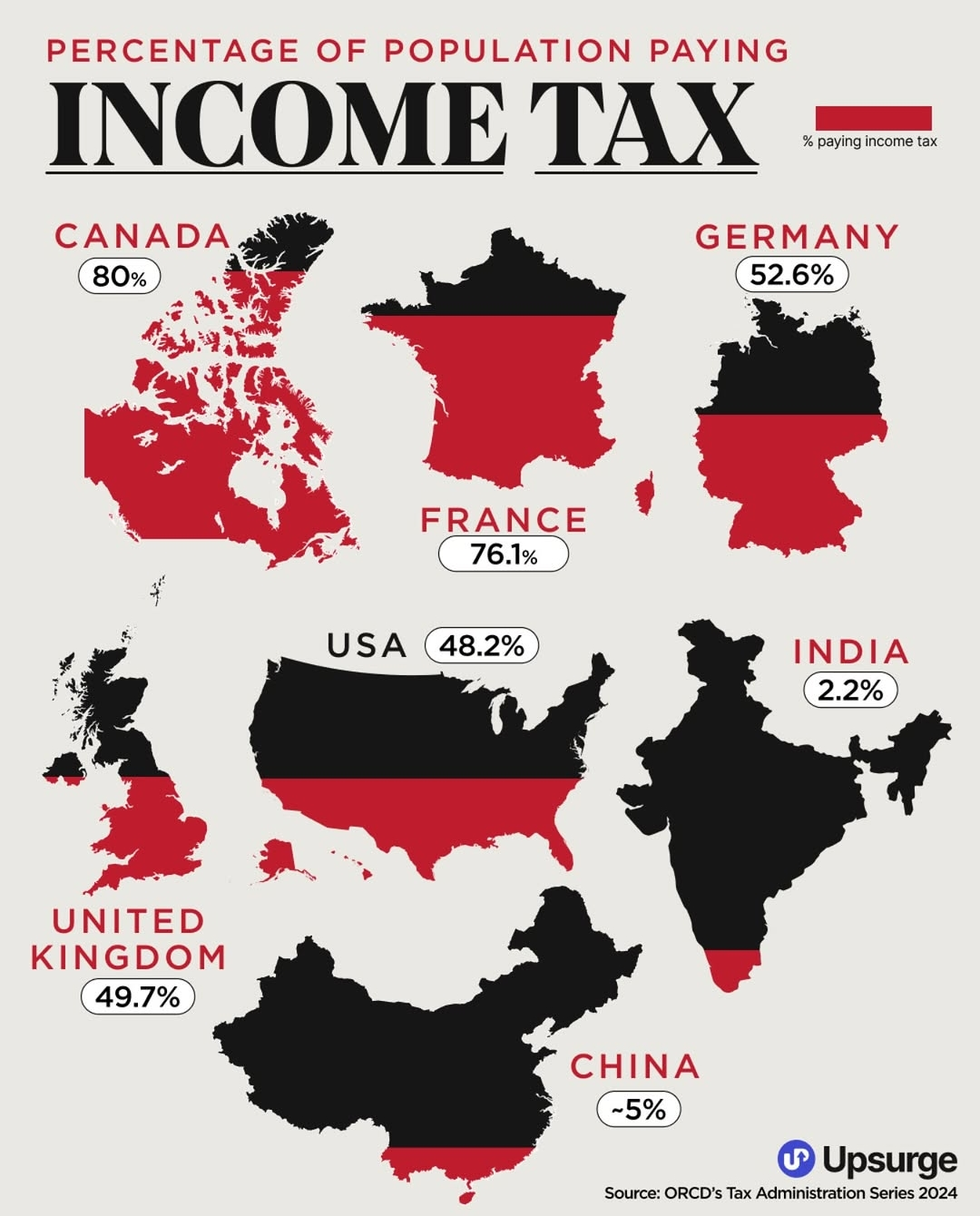

The "Percentage of Population Paying Income Tax Map 2024" offers a comprehensive overview of how many individuals in various regions are contributing to income tax systems across the globe. This visualization highlights the percentage of the population that is subject to income tax, revealing intriguing patterns and disparities in tax participation. It’s not just about numbers; this map reflects broader economic circumstances, cultural attitudes toward taxation, and governmental policies.

Deep Dive into Income Tax Participation

Income tax is a crucial source of revenue for governments, funding essential services such as education, healthcare, and infrastructure. The percentage of the population that pays income tax can serve as an indicator of economic health and individual financial stability. Interestingly, tax participation rates vary significantly across countries and regions, influenced by factors such as income levels, employment rates, and the structure of tax systems.

In many developed nations, the percentage of the population paying income tax tends to be higher. For instance, in countries like Sweden and Denmark, nearly all citizens contribute to income tax, reflecting robust welfare systems supported by higher tax rates. In these nations, tax compliance is viewed as a civic duty, fostering a strong sense of community and shared responsibility.

Conversely, in some developing countries, the percentage of the population paying income tax can be surprisingly low. Issues such as economic informality, where workers are not officially employed, and limited tax infrastructure hinder the ability of governments to collect taxes effectively. For example, countries in Sub-Saharan Africa often report low tax participation rates, with many citizens relying on informal economies where income is not reported or taxed.

In addition to economic factors, social attitudes towards taxation play a significant role. Have you noticed that in countries with higher trust in government institutions, such as Norway, tax compliance rates are generally higher? Citizens in these countries often feel assured that their taxes are being used effectively, which can enhance their willingness to contribute.

Regional Analysis

When we examine the map more closely, distinct regional patterns emerge. In North America, for example, the percentage of the population paying income tax is relatively high, with the United States reporting around 60% of its population actively filing income taxes. However, the tax code complexity and economic disparity mean that many low-income individuals may not pay federal income tax, highlighting the nuances behind these percentages.

In contrast, Latin America displays a more complex picture. Countries like Brazil and Mexico struggle with tax compliance due to large informal sectors. In Brazil, the percentage of the population paying income tax is approximately 30%, reflecting challenges in tax collection and enforcement. The wealth disparity in these countries often results in a disproportionate tax burden on the lower and middle classes, while wealthier individuals may evade taxes through loopholes.

Meanwhile, in Europe, we see a varied landscape. Western European nations exhibit high tax participation rates, sometimes exceeding 80%, thanks to efficient tax collection systems and a cultural predisposition towards tax compliance. However, Eastern European countries often report lower rates, with factors such as economic transition from post-Soviet structures affecting tax systems.

Significance and Impact

Understanding the percentage of the population paying income tax is crucial for several reasons. It not only informs us about governmental revenue but also highlights socioeconomic inequalities and the effectiveness of public services. As we navigate through changing economic landscapes, these percentages can reveal emerging trends—such as shifts in informal economies or the effectiveness of tax reforms.

Moreover, as governments seek to recover from the economic impacts of global events like the COVID-19 pandemic, maintaining or increasing tax participation will be essential for funding recovery efforts. Future projections suggest that countries investing in financial literacy and simplifying tax processes may see higher compliance rates, leading to improved public services and economic stability.

In conclusion, the "Percentage of Population Paying Income Tax Map 2024" is more than just a visualization of numbers; it's a window into the economic realities of different regions and the complex interplay between citizens and their governments. By analyzing these patterns, we can better understand the state of global economies and the importance of tax systems in shaping our societies.

Visualization Details

- Published

- September 14, 2025

- Views

- 62

Comments

Loading comments...