Debt to GDP Ratio by 2030 Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

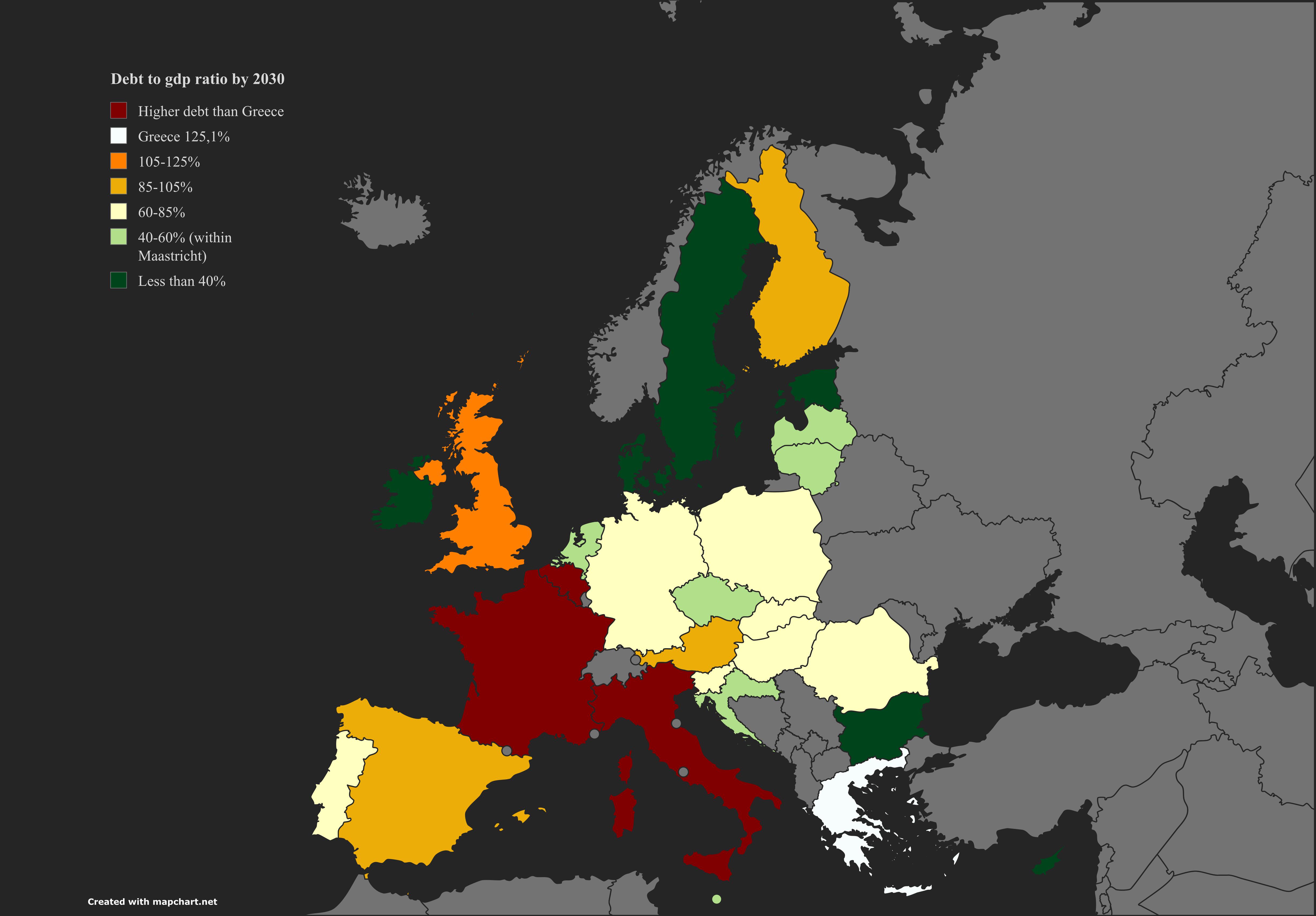

The visualization titled "Debt to GDP Ratio by 2030 in the EU and the UK according to the IMF" provides a comprehensive overview of the projected economic landscape of European nations, specifically focusing on the relationship between national debt and Gross Domestic Product (GDP). This important economic indicator is depicted across various countries, allowing viewers to grasp how each nation stands in terms of fiscal health and sustainability as we approach the next decade.

Debt to GDP ratio is a crucial measure that reflects the ability of a country to pay back its debts. A higher ratio may signal potential economic difficulties, while a lower ratio can indicate stronger economic fundamentals. What's fascinating is how this ratio can tell us so much about a country's economic policies, growth potential, and even the quality of life for its citizens.

Deep Dive into Debt to GDP Ratio

The Debt to GDP ratio is an essential metric in assessing a country's financial health. It is calculated by dividing a nation's total debt by its GDP, resulting in a percentage that can indicate how manageable a country’s debt burden is. Countries with a higher ratio may face challenges in attracting investment, managing inflation, and maintaining fiscal stability.

Interestingly, the International Monetary Fund (IMF) has been closely monitoring these trends within the European Union (EU) and the United Kingdom (UK). As we look forward to 2030, projections reveal significant variances across the continent. For instance, countries like Greece and Italy, which have historically struggled with high debt levels, are projected to maintain elevated ratios, indicative of their ongoing economic challenges.

Conversely, nations such as Germany and the Netherlands are expected to show a more favorable outlook, with lower debt ratios. This is largely attributed to their robust economies, strong export markets, and prudent fiscal management. The variance in these debt levels reflects not just economic performance, but also broader social and political factors.

For example, countries that have implemented strict fiscal consolidation measures tend to have healthier ratios, while those reliant on government spending to stimulate growth face steeper debt burdens. In some nations, high debt levels have led to austerity measures, which can impact social services and infrastructure development. This creates a paradox where the need for economic recovery may conflict with the immediate pressure to reduce debt.

Moreover, it’s crucial to consider the implications of these ratios beyond mere numbers. A rising Debt to GDP ratio can lead to increased borrowing costs, reduced public investment, and potentially slower economic growth. Countries with a high ratio may find themselves in a cycle of borrowing to pay off existing debt, which can create long-term economic stagnation.

Regional Analysis

When we break down the map by regions, we can observe some distinct patterns. Southern European countries, such as Spain, Portugal, and Italy, consistently show higher ratios compared to their Northern counterparts. For instance, Italy's Debt to GDP ratio is projected to hover around 150%, reflecting its ongoing economic challenges and recovery from previous crises. In contrast, countries like Sweden and Denmark are projected to maintain ratios below 50%, showcasing their strong fiscal policies and economic resilience.

In Eastern Europe, nations like Poland are emerging with improving debt dynamics, benefitting from robust economic growth and EU funding. Meanwhile, countries like Bulgaria are working towards lower ratios but still face significant economic hurdles. The diversity in economic performance across these regions highlights how historical context, governance, and economic policies shape financial futures.

Significance and Impact

Understanding the Debt to GDP ratio is more than just analyzing economic data; it has real-world implications for citizens and policymakers alike. A high Debt to GDP ratio can limit a government's ability to invest in crucial areas such as education, healthcare, and infrastructure. This can directly affect the quality of life for individuals and communities.

As we approach 2030, the trends depicted in this map will be critical for informing economic policies and strategies moving forward. Governments will need to assess their debt levels and consider how to stimulate growth while managing fiscal responsibilities. The ongoing impact of global events, such as economic downturns or geopolitical tensions, will also play a significant role in shaping these dynamics.

In conclusion, the Debt to GDP ratio is an essential indicator that speaks volumes about a country's economic health and future prospects. By examining the projections for 2030, we can gain valuable insights into the fiscal challenges and opportunities that lie ahead in Europe and the UK. As citizens, understanding these trends can empower us to engage more meaningfully in discussions around fiscal policy and economic governance.

Visualization Details

- Published

- September 9, 2025

- Views

- 98

Comments

Loading comments...