Average Annual Property Tax by State Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

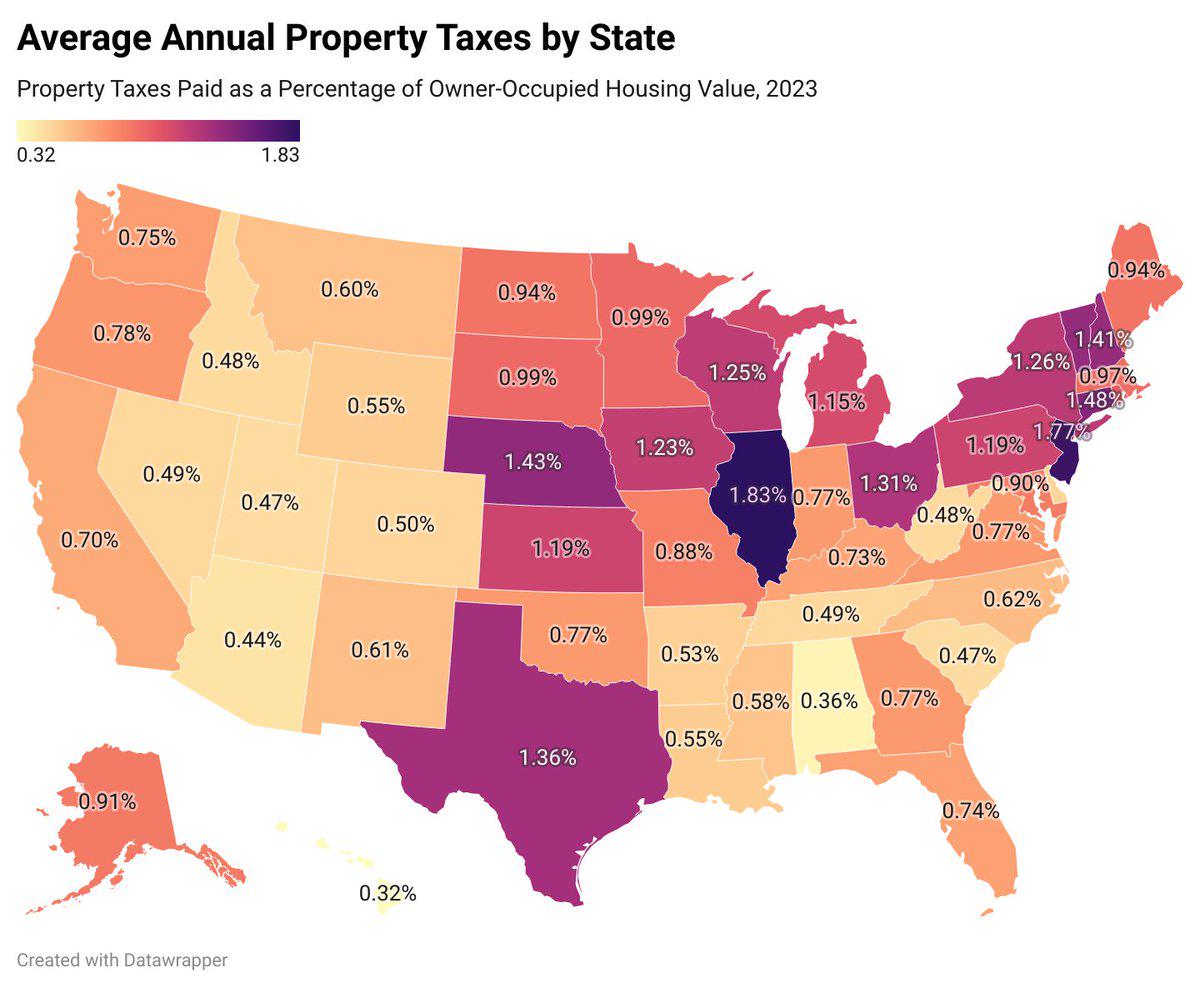

This map displays the average annual property tax by state across the United States, offering a clear visual representation of how property tax rates vary from region to region. As we delve into the specifics of property taxes, it’s essential to understand their implications for homeowners, renters, and local economies alike.

Deep Dive into Property Taxes

Property taxes are a primary source of revenue for local governments, funding essential services such as education, infrastructure, public safety, and community development. They are typically assessed based on the value of real estate properties, including residential, commercial, and industrial spaces. This means that the higher the property value, the higher the property tax bill.

Interestingly, property tax rates do not uniformly reflect property values across the nation. States in the Northeast and Midwest tend to have higher average property tax rates. For instance, New Jersey often tops the list with some of the highest rates, largely due to its reliance on property taxes for funding public schools. In 2022, the average effective property tax rate in New Jersey was around 2.13%, which is significantly higher than the national average of about 1.07%.

Conversely, states in the Mountain West and Inner South, such as Wyoming and Alabama, showcase much lower property tax rates. Wyoming, for example, boasts an average property tax rate of around 0.61%. This disparity is influenced by various factors, including state policies, the availability of alternative revenue sources, and the overall economic landscape.

Moreover, property tax assessments can lead to debates about fairness and equity. Homes are often assessed at different rates depending on their location, condition, and market trends. In some areas, homeowners may feel that their property taxes do not accurately reflect the value of their homes, leading to calls for reform.

Regional Analysis

Breaking down the map, we can see distinct patterns emerging in various regions. The Northeast, which includes states like Massachusetts and Connecticut, typically has high property tax rates. In contrast, the Midwest states, such as Illinois and Wisconsin, also report elevated property tax averages, reflecting similar funding structures for local services.

On the other hand, the Mountain West showcases a different approach. States like Idaho and Montana have lower property tax rates, partially due to their abundant natural resources, which provide alternative funding avenues. This has allowed them to maintain lower taxes while still supporting essential public services.

In the Inner South, states like Mississippi and Arkansas also exhibit lower property tax rates. These states rely more heavily on sales taxes and income taxes, which can lead to a more balanced tax structure but might also create financial challenges for local governments when economic downturns occur.

Interestingly, variations in property tax rates can also reflect broader economic conditions and demographic trends. For instance, states experiencing rapid population growth, like Texas, may see property taxes rise as demand for housing increases. Conversely, states with stagnant populations might struggle to generate the same level of revenue, leading to potential cuts in public services.

Significance and Impact

Understanding property tax rates is crucial for homeowners and potential buyers alike. High property taxes can significantly impact affordability, influencing decisions about where to live and invest. Moreover, communities with high property taxes may face challenges in attracting new residents or businesses, as potential newcomers often weigh tax burdens against the benefits of living in those areas.

Current trends show that property taxes are becoming an increasingly contentious issue, especially in rapidly growing states. As cities expand and infrastructure needs grow, local governments may turn to property taxes as a primary funding source. This could lead to increased rates, further stimulating discussions about tax equity and fairness.

Looking ahead, the landscape of property taxes may continue to evolve. With changes in state policies, the ongoing effects of economic shifts, and the impact of housing market fluctuations, understanding these trends will be vital for residents and policymakers alike. Have you ever wondered how property taxes in your state compare to others? With this map, it’s easier than ever to visualize the disparities and engage in conversations about the value placed on real estate and the services funded by these taxes.

Visualization Details

- Published

- September 1, 2025

- Views

- 64

Comments

Loading comments...