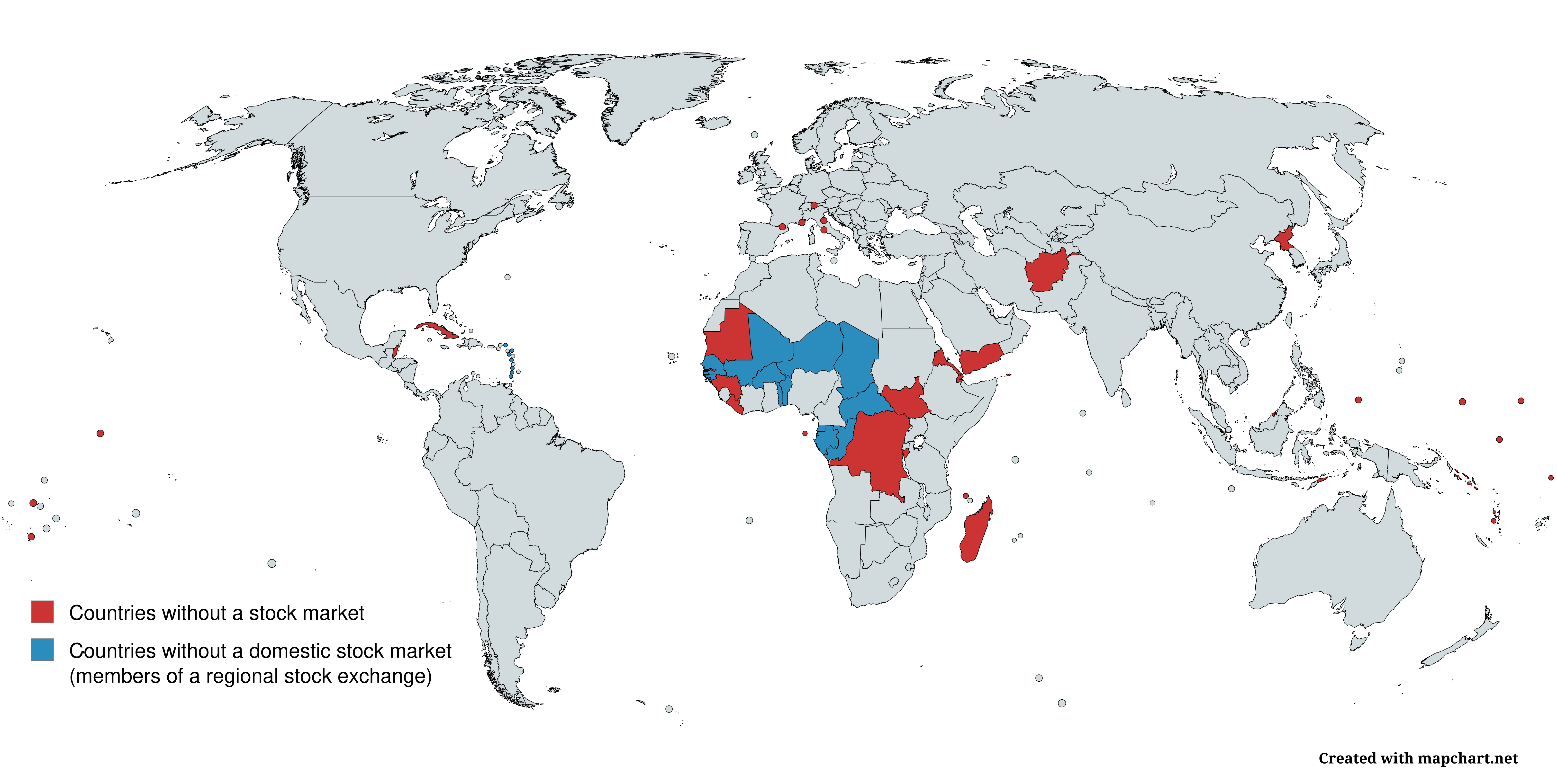

Countries Without a Stock Market Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

This map highlights countries that do not have a functioning stock market. A stock market is a vital component of a modern economy, facilitating the buying and selling of shares, providing companies access to capital, and offering investors a platform to grow their wealth. However, the absence of a stock market in certain countries can reflect a range of economic, political, and infrastructural challenges. Understanding these contexts is crucial to grasping why these nations operate without such financial systems.

Deep Dive into Countries Without Stock Markets

Ever wondered why some countries lack a stock market? The reasons are multifaceted and often intertwined with the nation’s economic health, governance, and historical context. For many nations without stock markets, economic activities may be dominated by agriculture, informal sectors, or state-controlled enterprises. This lack of diversification can hinder the development of a formalized capital market.

For instance, countries like Afghanistan and South Sudan have faced prolonged instability and conflict, which not only impacts economic growth but also deters foreign investment and the establishment of robust financial institutions. In such environments, the infrastructure needed for a stock market – including regulatory bodies, legal frameworks, and technological support – is often absent or underdeveloped.

Interestingly, some nations may opt to forgo a stock market altogether in favor of alternative financing methods. For example, many smaller economies rely on foreign direct investment or remittances from citizens working abroad. In these cases, the economic landscape may not require a formal stock exchange to facilitate growth.

In contrast, some countries with modest economies, such as Bhutan, have begun exploring the establishment of stock markets as a means to promote economic growth. The Royal Monetary Authority of Bhutan has been looking into ways to create a stock exchange that can attract investment and provide a platform for local businesses to raise capital.

Moreover, the absence of a stock market can also signify a lack of financial literacy among the population. In many countries without stock markets, a significant portion of the population may not have access to banking services, which further complicates investment opportunities. Financial education is vital for encouraging investment and participation in any future capital markets.

Regional Analysis

When we break this topic down regionally, the variations become even more pronounced. In Africa, many countries without stock markets are struggling with economic instability and governance issues. Countries like Eritrea and Zimbabwe have faced severe economic challenges and hyperinflation, leading to a lack of investor confidence.

In contrast, some regions in Asia, such as Southeast Asia, have seen emerging economies begin to establish stock markets. For example, Laos is on the path to developing its stock market, even though it currently lacks one. This difference shows a positive trend towards integrating these economies into the global financial system.

In the Middle East, countries like Yemen and Syria are also without stock markets, primarily due to ongoing conflict and instability, which have made economic development nearly impossible. The situation is particularly dire in these nations, where the focus is often on survival rather than economic growth.

Significance and Impact

Understanding the implications of countries without stock markets is essential in today’s interconnected world. The absence of a stock market often results in limited economic growth, reduced foreign investment, and a lack of financial opportunities for citizens. This can perpetuate cycles of poverty and limit the potential for development.

Current trends show that as globalization continues to impact economies worldwide, more nations are beginning to recognize the importance of establishing stock markets. Countries that currently lack a stock market may find that creating one can lead to increased transparency, better governance, and improved economic conditions.

Looking towards the future, it is crucial for these nations to develop the necessary frameworks to support stock markets. This includes investing in education, infrastructure, and governance. As more countries join the global economic system, the potential for growth and development increases, ultimately benefiting millions of people.

In conclusion, the map depicting countries without a stock market serves as a visual reminder of the economic disparities that exist in our world today. As nations continue to evolve, the potential for growth in regions currently without stock markets provides hope for a more equitable financial landscape in the future.

Visualization Details

- Published

- August 30, 2025

- Views

- 86

Comments

Loading comments...