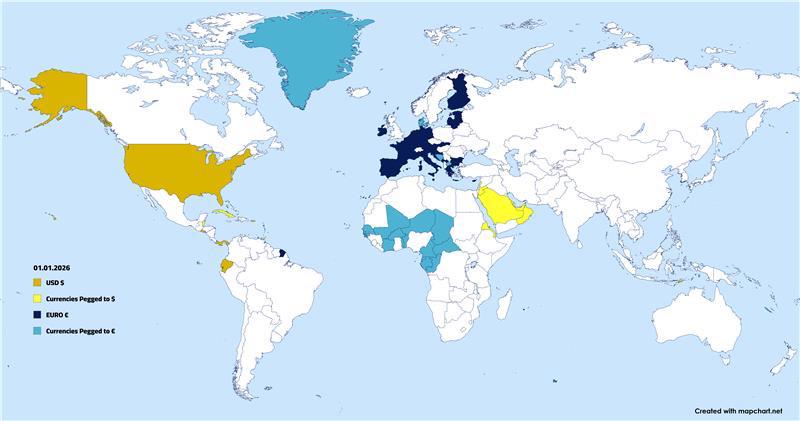

Map of Global Usage of Dollar and Euro

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

This map illustrates the global usage of the two dominant reserve currencies: the US dollar (USD) and the euro (EUR). It highlights the countries where these currencies are most widely used, not just domestically but also in international trade and finance. The visualization provides an insightful look into how these currencies dominate the global financial landscape, revealing patterns of economic influence and dependency.

Deep Dive into Reserve Currencies

Reserve currencies are foreign currencies held in significant quantities by governments and institutions as part of their foreign exchange reserves. The most notable among these are the US dollar and the euro. The US dollar has long been considered the world’s primary reserve currency, accounting for approximately 60% of global reserves, according to the International Monetary Fund (IMF). This dominance is not merely a product of American economic power but also reflects the dollar's established role in global trade and finance.

Interestingly, the euro, introduced in 1999, was designed to enhance economic stability and foster integration among European nations. It has grown to represent around 20% of global reserves, making it the second most important reserve currency. A key factor contributing to the euro's rise is the size and strength of the Eurozone economies, which include powerhouses like Germany and France.

Have you ever wondered why the dollar remains so dominant? A significant reason is the liquidity of the dollar-denominated assets. Investors and governments prefer holding dollars due to the deep and liquid nature of American financial markets. Moreover, the dollar is the standard currency for most commodities, including oil, which reinforces its status.

The euro, while strong, faces unique challenges. The lack of a unified fiscal policy across Eurozone countries creates vulnerabilities that can affect confidence in the euro. Yet, as the European Union continues to strengthen its economic ties, the euro's role as a reserve currency may continue to expand.

Regional Analysis

When looking at the map, we can see distinct patterns in the usage of the dollar and euro across different regions. In North America, the dollar reigns supreme, with nearly all financial transactions and reserves held in USD. Conversely, in Europe, the euro is widely adopted, reflecting the economic integration of the region.

Interestingly, in regions like Latin America and parts of Asia, we find a mix of both currencies. Countries such as Ecuador and El Salvador have adopted the US dollar as their official currency, while nations like Brazil and Argentina still maintain their local currencies but often transact in USD, especially in international trade.

In Africa, the situation is more complex. Some nations use the euro or dollar for trade, while others rely on their local currencies. Countries like Tunisia and Morocco exhibit a strong euro presence due to their trade relationships with Europe. Meanwhile, in Asia, the dollar dominates, but countries like China are increasingly promoting the yuan in international transactions, aiming to gradually reduce their dependency on the dollar.

Significance and Impact

The implications of the dollar and euro's dominance are profound. When a currency is widely accepted, it can lead to lower transaction costs and greater efficiency in international trade. However, for countries that rely heavily on foreign currencies, fluctuations in these currencies can have significant economic consequences. For instance, a strong dollar can make exports from dollar-dependent countries more expensive, potentially harming their economies.

Looking into the future, the dynamics of reserve currencies may shift. With the rise of digital currencies and increasing discussions around alternatives to the dollar, such as the Chinese yuan or even cryptocurrencies, the global financial landscape is poised for change. However, the dollar and euro currently remain at the forefront, significantly influencing global economics and trade. Understanding their usage across the globe is not just an academic exercise; it's essential for grasping the complexities of today's interconnected economy.

Visualization Details

- Published

- August 12, 2025

- Views

- 104

Comments

Loading comments...