Median Real Estate Taxes Paid Map for Homes Without Mortgages

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

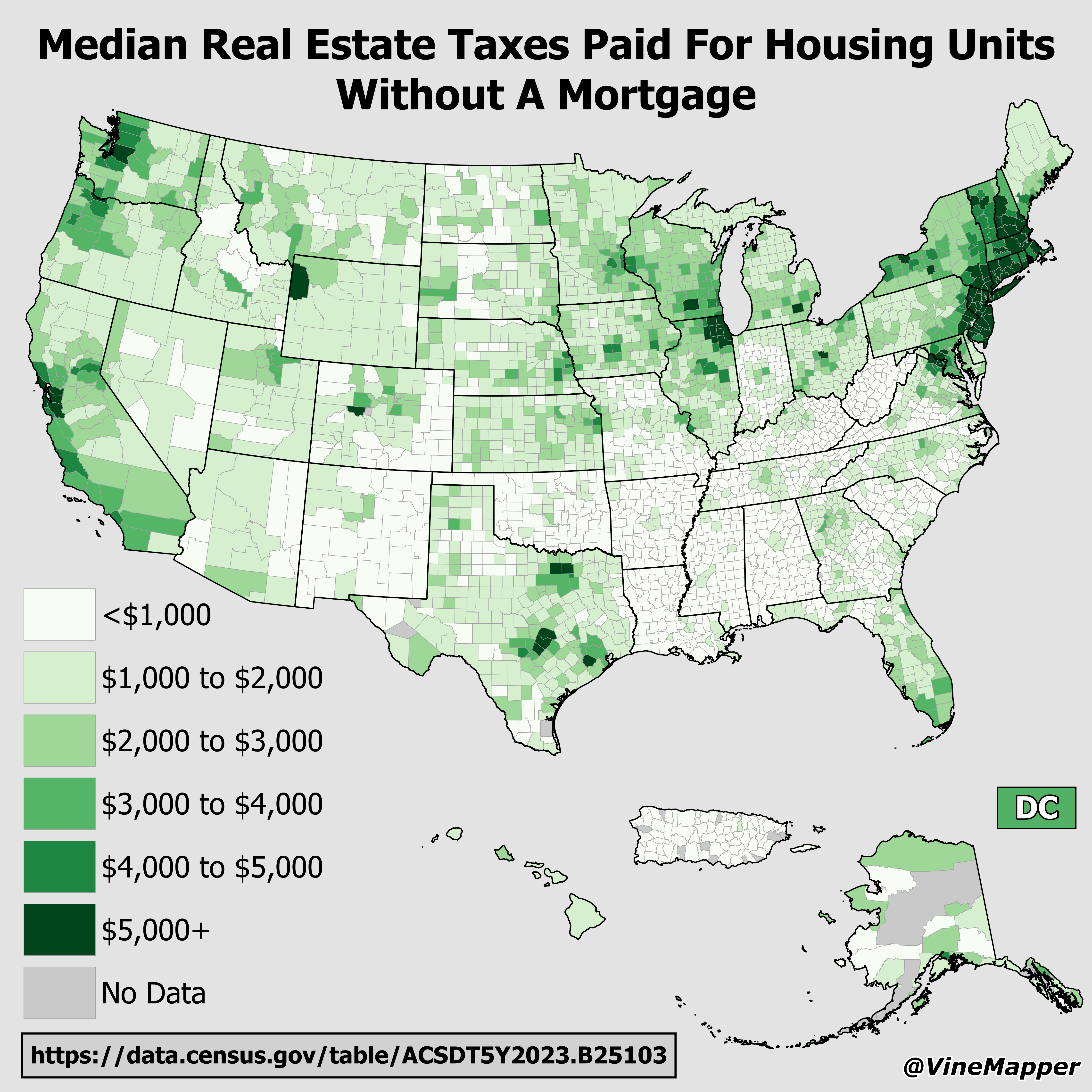

The "Median Real Estate Taxes Paid for Housing Units Without a Mortgage" map provides a clear visualization of the real estate tax burdens experienced by homeowners who do not have a mortgage. This particular demographic is critical for understanding how property taxes vary across the United States, reflecting not only local tax policies but also the economic conditions and housing markets of different regions. Real estate taxes can significantly impact homeowners' finances, influencing their decisions on property ownership and community investment.

Deep Dive into Real Estate Taxes

Real estate taxes, often referred to as property taxes, are levied by local governments and are typically based on the assessed value of residential properties. For homeowners without mortgages, these taxes represent a crucial aspect of their financial responsibility, as they must pay them without the offset of a mortgage. This is particularly relevant in areas where home ownership has increased, and individuals may be living on fixed incomes, such as retirees.

Interestingly, property tax rates can vary widely from state to state and even within counties. For instance, states like New Jersey and Illinois often rank among the highest in terms of property tax rates, while others, such as Hawaii and Alabama, tend to have much lower rates. This variation raises questions about the factors driving these disparities. Economic conditions, local government funding requirements, and the overall housing market all play a role in determining these rates.

Moreover, the distribution of property tax revenue is essential for funding local services such as schools, public safety, and infrastructure. Therefore, understanding the landscape of real estate taxes for homeowners without mortgages can provide insights into how well communities are funded and the quality of services residents receive.

According to recent statistics, homeowners without a mortgage paid an average of $2,090 in property taxes annually, but this number is subject to significant fluctuations based on location. In some regions, particularly those with high property values or strong municipal budgets, homeowners can face tax bills exceeding $10,000 annually. Conversely, in areas with lower home values and tax rates, the burden can be as low as a few hundred dollars.

Another interesting aspect is the impact of local policies on property taxes. For example, places that have implemented tax relief programs for seniors or low-income households often see different tax burdens for these groups. Similarly, areas that have experienced rapid growth may adjust their tax structures to accommodate new residents and infrastructure demands, leading to potential increases in taxes over time.

Regional Analysis

When we analyze the map, regional differences become immediately apparent. In the Northeast, states like New York and Connecticut showcase some of the highest median real estate taxes for homeowners without mortgages. For example, a homeowner in Westchester County, NY, might pay over $10,000 annually, largely due to the high property values and robust local services. Conversely, in the South, states like Mississippi and Louisiana often have much lower property tax rates, with homeowners paying significantly less.

In the Midwest, we find a mixed bag. States like Wisconsin have relatively high property taxes, while others such as Indiana offer more moderate rates. Interestingly, this can be attributed to the varying economic health of these states. For instance, urban areas may require higher taxes to fund public services adequately, while rural areas may have lower demands.

Out West, states like California have complex property tax laws, including Proposition 13, which limits increases in property taxes for long-term owners. This can create significant disparities between long-term homeowners and new buyers, who may face much higher taxes due to the current market value of their properties.

Significance and Impact

Understanding the dynamics of median real estate taxes for homeowners without mortgages is crucial for several reasons. First, it sheds light on the economic pressures faced by this demographic, particularly as many are on fixed incomes. Ever wondered why some retirees struggle to maintain their homes? Rising property taxes can be a significant factor.

Moreover, as communities evolve and property values fluctuate, the implications of these taxes can lead to broader discussions about affordability and housing accessibility. Many areas are grappling with the balance between maintaining adequate funding for local services and ensuring that taxes do not become a burden for residents. As trends indicate a growing number of homeowners are entering the market without mortgages—due to factors like increased home equity or demographic shifts—monitoring these tax patterns will remain essential.

In conclusion, the map of median real estate taxes paid by homeowners without a mortgage not only highlights regional disparities but also opens the door for important conversations about local governance, economic health, and community sustainability. As we move forward, understanding these dynamics will be essential for policymakers, economists, and residents alike.

Visualization Details

- Published

- October 10, 2025

- Views

- 42

Comments

Loading comments...