Digital Real Time Payments by Country Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

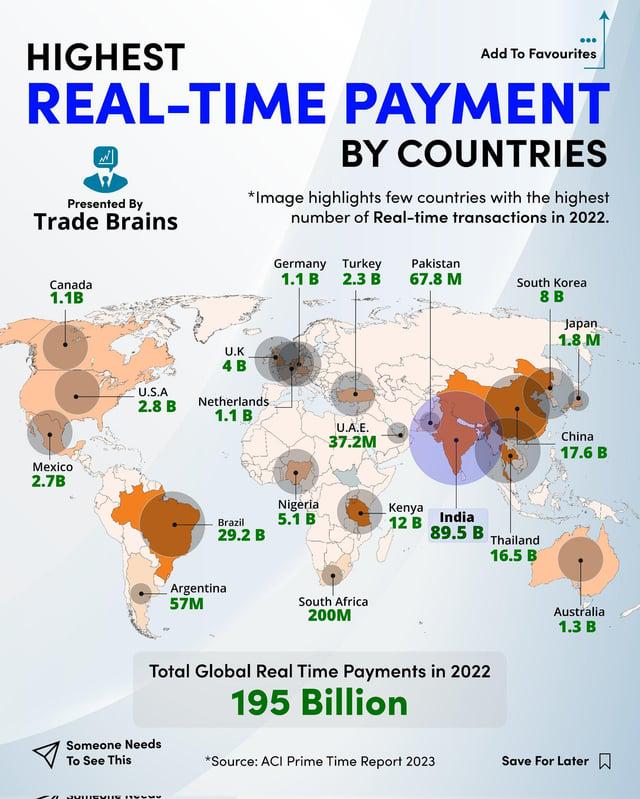

The "Countries by Highest Digital Real Time Payments - 2022" map offers an insightful look into the global landscape of digital payment systems. Specifically, it outlines which nations have embraced real-time payment technologies, showcasing the volume and prevalence of such transactions. These digital real-time payments include a range of services, from instant bank transfers to mobile payment solutions that allow consumers and businesses to transact with unprecedented speed and efficiency.

As we delve into the topic of digital payments, it’s worth noting that the rise of technology has fundamentally transformed financial transactions, making them faster, safer, and more convenient. This shift is not just about convenience; it reflects broader changes in consumer behavior, technological adoption, and even regulatory environments across different countries.

Deep Dive into Digital Real Time Payments

Digital real-time payments are a significant aspect of the modern economy. They represent a shift from traditional banking methods to instantaneous transactions, often facilitated by mobile apps and online platforms. In 2022, the surge in digital real-time payments can be attributed to several factors, including the global pandemic, which accelerated the adoption of digital finance as people sought contactless ways to handle their transactions.

Interestingly, data from the World Bank indicates that real-time payments can boost economic activities by enhancing cash flow for businesses and providing consumers with immediate access to their funds. Countries that have successfully implemented real-time payment systems often see not just a rise in transaction volumes but also improvements in overall economic efficiency.

For instance, countries like China and India stand out on the map for their high volumes of digital payments. China's Alipay and WeChat Pay have created an ecosystem where cash is almost obsolete. In 2022, it was reported that digital payments in China reached over $60 trillion, showcasing the country's massive adoption of real-time payment solutions.

Meanwhile, India has made significant strides with its Unified Payments Interface (UPI), which allows users to make instantaneous bank transfers using mobile devices. The platform has seen exponential growth, with digital transactions exceeding 45 billion in 2022, a clear indicator of how rapidly India is transitioning towards a cashless economy.

However, it’s not just the Asian giants leading the charge. Countries like the United States and Sweden are also notable for their robust digital payment infrastructures. The U.S. has seen an increase in payment apps like Venmo and Zelle, which facilitate quick money transfers among users. In Sweden, cash usage is declining, with the majority of transactions now occurring digitally, supported by a strong regulatory environment that encourages innovation in the payment sector.

Regional Analysis

Examining the map, it's intriguing to see how digital payment adoption varies by region. In North America, the U.S. and Canada show significant engagement with digital payments, but their systems differ. The U.S. leans heavily on peer-to-peer payment platforms, while Canada has seen the rise of Interac e-Transfer as a popular method.

In Europe, countries like the UK and Germany are also adapting rapidly to digital payments, yet there’s a noticeable variation in acceptance. The UK has widely embraced contactless payments, with figures showing that nearly 50% of card transactions in 2022 were contactless, while Germany has been slower to abandon cash, indicating a cultural resistance to digital solutions.

In contrast, regions such as Africa and Latin America are experiencing a rapid growth trajectory in digital payments, albeit from a lower base. Countries like Kenya with its M-Pesa service have pioneered mobile payments in Africa, illustrating how innovative solutions can leapfrog traditional banking infrastructure. Similarly, in Brazil, fintech startups are revolutionizing the payment landscape with platforms that cater to the unbanked population, promoting financial inclusion.

Significance and Impact

The significance of digital real-time payments cannot be overstated. As global commerce shifts towards digital platforms, the ability to conduct transactions instantly is becoming a crucial competitive advantage. For businesses, this means improved cash flow, reduced transaction costs, and enhanced customer satisfaction. For consumers, the immediate access to funds facilitates better financial management and spending.

Moreover, the implications extend beyond just financial transactions. The growth of digital payment systems can lead to economic empowerment, particularly in developing nations where traditional banking infrastructure is lacking. By providing easier access to financial services, digital payments can drive economic growth, increase participation in the formal economy, and ultimately contribute to poverty reduction.

Looking forward, trends indicate that the adoption of digital real-time payments will continue to rise, driven by innovations in technology and changing consumer preferences. As more people recognize the benefits of instant transactions, we can expect to see an even greater shift towards a cashless society in the coming years.

In conclusion, the map of digital real-time payments by country in 2022 not only highlights which nations are leading the way but also reflects broader economic shifts that are reshaping how we think about money and transactions. As we navigate this digital landscape, it will be fascinating to observe how these trends evolve and the impact they will have on global economies.

Visualization Details

- Published

- August 28, 2025

- Views

- 68

Comments

Loading comments...