Payday Loan Interest Rates by State Map

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

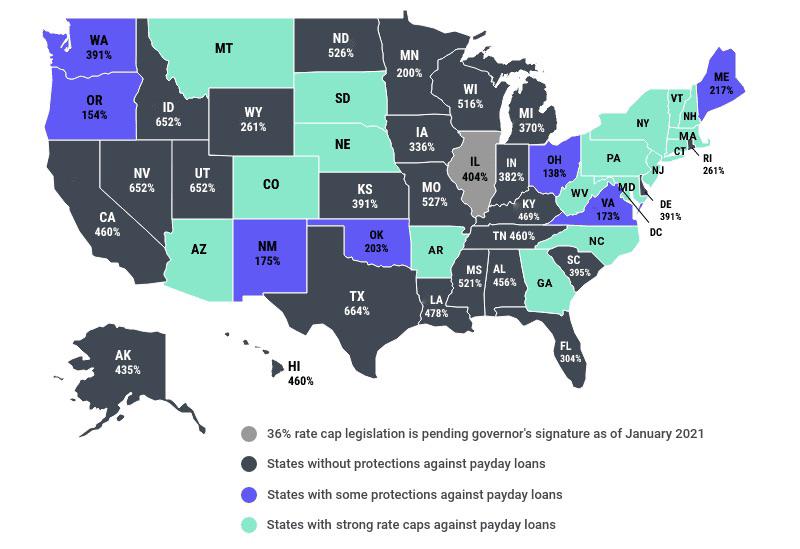

The map titled "The Typical Payday Loan Interest Rates in U.S. States and If They Have Any Legislative Protections" provides a comprehensive visual representation of payday loan interest rates across the United States. It also highlights which states have implemented legislative measures to protect consumers from predatory lending practices. This visualization is crucial for understanding not just the financial landscape but also the regulatory environment surrounding payday loans.

Deep Dive into Payday Loan Interest Rates

Payday loans are short-term, high-interest loans designed to bridge the gap between paychecks for individuals facing immediate financial needs. These loans typically carry exorbitant interest rates, with many states allowing lenders to charge rates that can exceed 400% annually. Interestingly, the lack of federal regulation means that the rules governing payday loans vary significantly from state to state.

In states like Texas and Utah, borrowers can be confronted with some of the highest interest rates in the nation, often reaching up to 600%. This is alarming, especially when you consider that the average payday loan is repaid within a couple of weeks. The cumulative effect of such interest rates can trap borrowers in a cycle of debt, making it nearly impossible for them to escape financial distress.

Conversely, states like Massachusetts and New York have implemented stricter regulations, capping payday loan interest rates at 23% and 25%, respectively. These legislative protections are critical in safeguarding consumers against exploitative practices. In fact, a study from the Consumer Financial Protection Bureau (CFPB) revealed that states with stricter regulations tend to have lower rates of payday loan defaults and fewer bankruptcies, showcasing the positive impact of legislative action.

Furthermore, the payday loan industry has faced increasing scrutiny in recent years. As public awareness of the consequences of high-interest loans grows, advocacy groups are pushing for stricter regulations nationwide. This shift is not just about consumer protection; it also reflects broader concerns regarding economic inequality and access to fair financial services. The ongoing debate about payday loans highlights the need for financial literacy and better consumer education.

Regional Analysis

When analyzing the map regionally, we see distinct trends that emerge across different parts of the country. The South, for instance, generally exhibits some of the highest payday loan interest rates. States like Alabama and Mississippi have minimal regulations, allowing lenders to impose sky-high fees that can leave borrowers in dire straits.

In contrast, the Northeast showcases a more protective stance toward consumers. Here, states like New Jersey have banned payday loans altogether, while those that allow them impose strict interest rate caps. Interestingly, this regional divide indicates varying cultural attitudes towards lending and consumer rights, which can be traced back to historical economic conditions in these areas.

The Midwest presents a mixed picture. States like Ohio have undergone significant changes in their payday lending laws in recent years, reflecting a growing awareness of the need for consumer protection. On the other hand, states such as Indiana and Michigan still permit relatively high-interest rates, which can lead to financial strain for low-income residents.

Significance and Impact

Understanding payday loan interest rates and the protective measures in place is essential for comprehending broader economic trends in the United States. As economic conditions fluctuate, more individuals may turn to payday loans as a last resort, particularly in times of crisis. This reliance can exacerbate cycles of debt, leading to a significant impact on local economies and communities.

Moreover, the conversation around payday lending is increasingly intertwined with discussions about financial literacy and consumer rights. Have you noticed how many advocacy groups are emerging to educate consumers about their options? The growing movement towards financial education seeks to empower individuals to make informed choices, potentially reducing the reliance on high-interest loans.

As we look to the future, it's crucial to monitor legislative changes regarding payday loans, as these decisions will shape the economic landscape for millions of Americans. With ongoing discussions about reform and regulation, the potential for change is palpable. The map serves as a vital tool for understanding these dynamics, making it an essential resource for anyone interested in the intersection of finance and consumer rights.

Visualization Details

- Published

- August 24, 2025

- Views

- 84

Comments

Loading comments...