Map of European Attitudes on Wealth Taxation

Alex Cartwright

Senior Cartographer & GIS Specialist

Alex Cartwright is a renowned cartographer and geographic information systems specialist with over 15 years of experience in spatial analysis and data...

Geographic Analysis

What This Map Shows

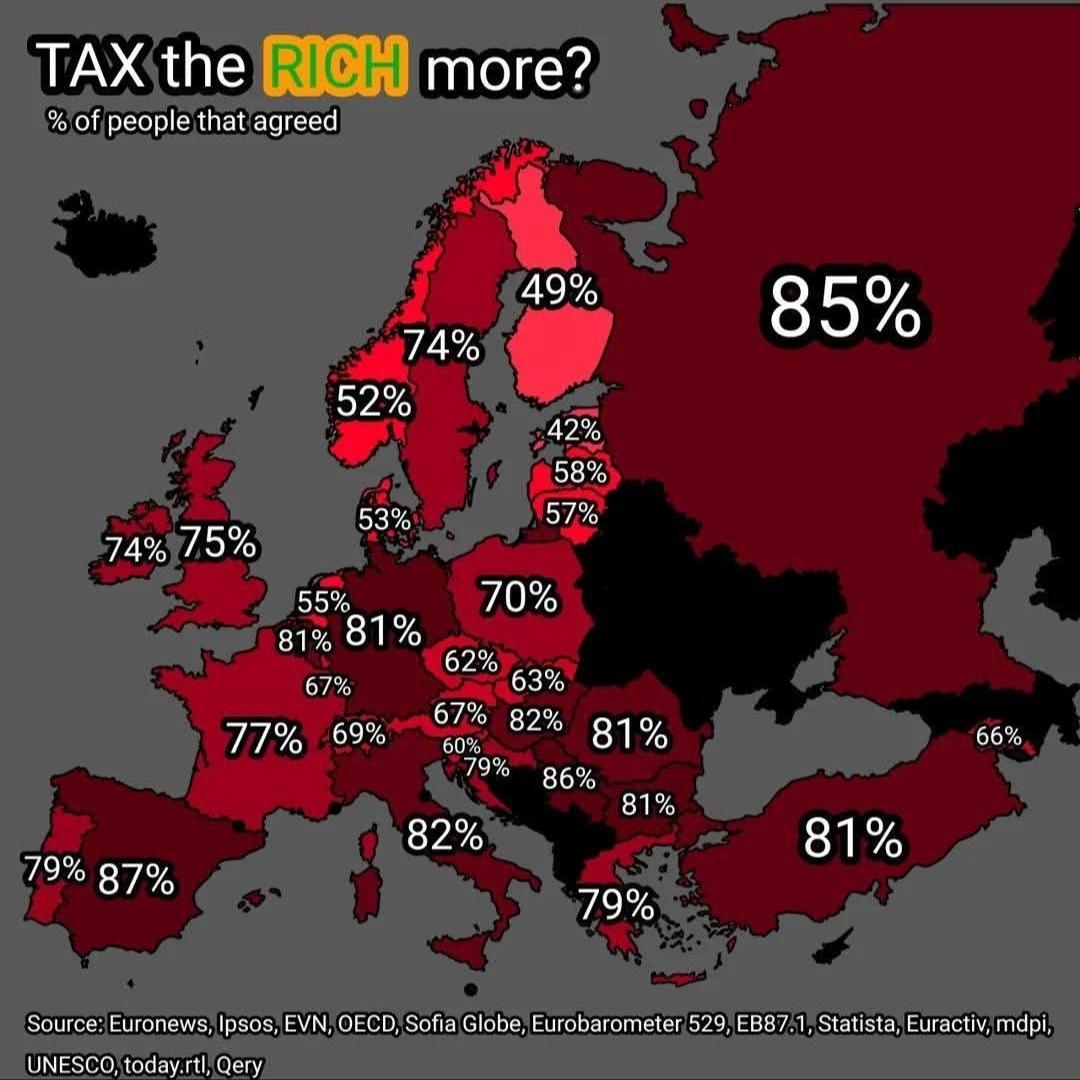

The visualization titled "Average European Believes the Rich Should Be Taxed More" illustrates the varying levels of agreement among European nations regarding the taxation of wealthier individuals. Each country is color-coded based on survey data reflecting public sentiment about increasing taxes on the rich, providing a clear snapshot of how different societies view economic equity and social responsibility.

This topic is timely and relevant, especially as discussions on wealth inequality and taxation policy are increasingly at the forefront of political debates across Europe. Understanding how the average citizen in these countries feels about taxing the wealthy can offer insights into broader economic and social trends.

Deep Dive into Wealth Taxation Attitudes

Interestingly, the attitudes toward wealth taxation are deeply influenced by historical, cultural, and economic factors unique to each nation. Wealth taxation generally refers to the idea of taxing individuals based on their assets, income, or net worth. This concept is not new; it has been a part of various taxation systems for centuries in different forms.

In Europe, where social welfare systems are more prevalent compared to other regions, the idea of taxing the rich is often seen as a means to redistribute wealth and fund public services. For instance, Scandinavian countries like Sweden and Denmark have long embraced high taxation on the wealthy, resulting in robust welfare programs that support healthcare, education, and social services. According to recent surveys, a significant percentage of citizens in these countries believe that higher taxes on the rich are not only justified but necessary for maintaining social equity.

On the other hand, nations like the United Kingdom and Germany show a more varied response. While many citizens support the idea of taxing the wealthy, there is also a considerable population that is hesitant, often citing concerns about potential negative impacts on economic growth and investment. The debate is nuanced, with opinions often divided along political lines, reflecting broader ideological divides regarding the role of government in wealth redistribution.

Furthermore, the economic backdrop plays a crucial role in shaping these attitudes. Countries experiencing higher levels of inequality, such as Spain and Italy, tend to show stronger support for taxing the rich. Economic challenges, such as high unemployment rates or stagnant wages, often fuel public sentiment that advocates for a fairer distribution of wealth. In contrast, nations with lower inequality may exhibit a more cautious approach to wealth taxation, favoring policies that incentivize wealth creation rather than redistribution.

Regional Analysis

Breaking down the map regionally reveals fascinating contrasts in attitudes toward wealth taxation. For example: - **Nordic Countries**: As mentioned earlier, the Nordic countries generally show overwhelming support for taxing the wealthy. Citizens in Sweden and Finland, for instance, believe that higher taxes on the rich can help maintain their comprehensive welfare systems. - **Western Europe**: Countries like France and Belgium also lean towards favoring wealth taxes, but with notable differences. French citizens express strong support for wealth taxation, reflecting a long-standing tradition of class struggle and a robust public discourse on economic justice. Conversely, in Belgium, there is a more divided opinion, with significant portions of the population concerned about tax efficiency and fairness. - **Southern Europe**: In Spain and Italy, a significant percentage of the population supports wealth taxation, driven by economic struggles and high youth unemployment rates. The sentiment here is often connected to the perceived injustices of wealth concentration in the hands of a few. - **Eastern Europe**: Attitudes in Eastern European countries are more complex and varied. For instance, Poland shows a more favorable view towards taxing the wealthy, while Hungary demonstrates skepticism about wealth redistribution, likely influenced by recent political developments and economic policies.

Significance and Impact

Understanding the sentiments behind wealth taxation is crucial, especially as we face a rapidly changing economic landscape. The implications of public attitudes toward wealth taxation extend beyond mere opinion polls; they can influence government policies, electoral outcomes, and the overall economic health of nations.

As wealth inequality continues to rise globally, European countries are grappling with how to address this pressing issue. Higher taxation on the rich is often proposed as a solution to fund social programs, reduce inequality, and promote social cohesion. However, the challenge remains to strike a balance that fosters economic growth while addressing the needs of the most vulnerable in society.

Interestingly, the dialogue around wealth taxation is evolving. With the rise of movements advocating for economic justice and increased awareness of wealth disparities, public opinion may shift further towards supporting taxation of the wealthy. As we move into the future, it will be fascinating to see how these beliefs translate into policy and what impact they will have on the socio-economic landscape of Europe.

Visualization Details

- Published

- October 27, 2025

- Views

- 16

Comments

Loading comments...