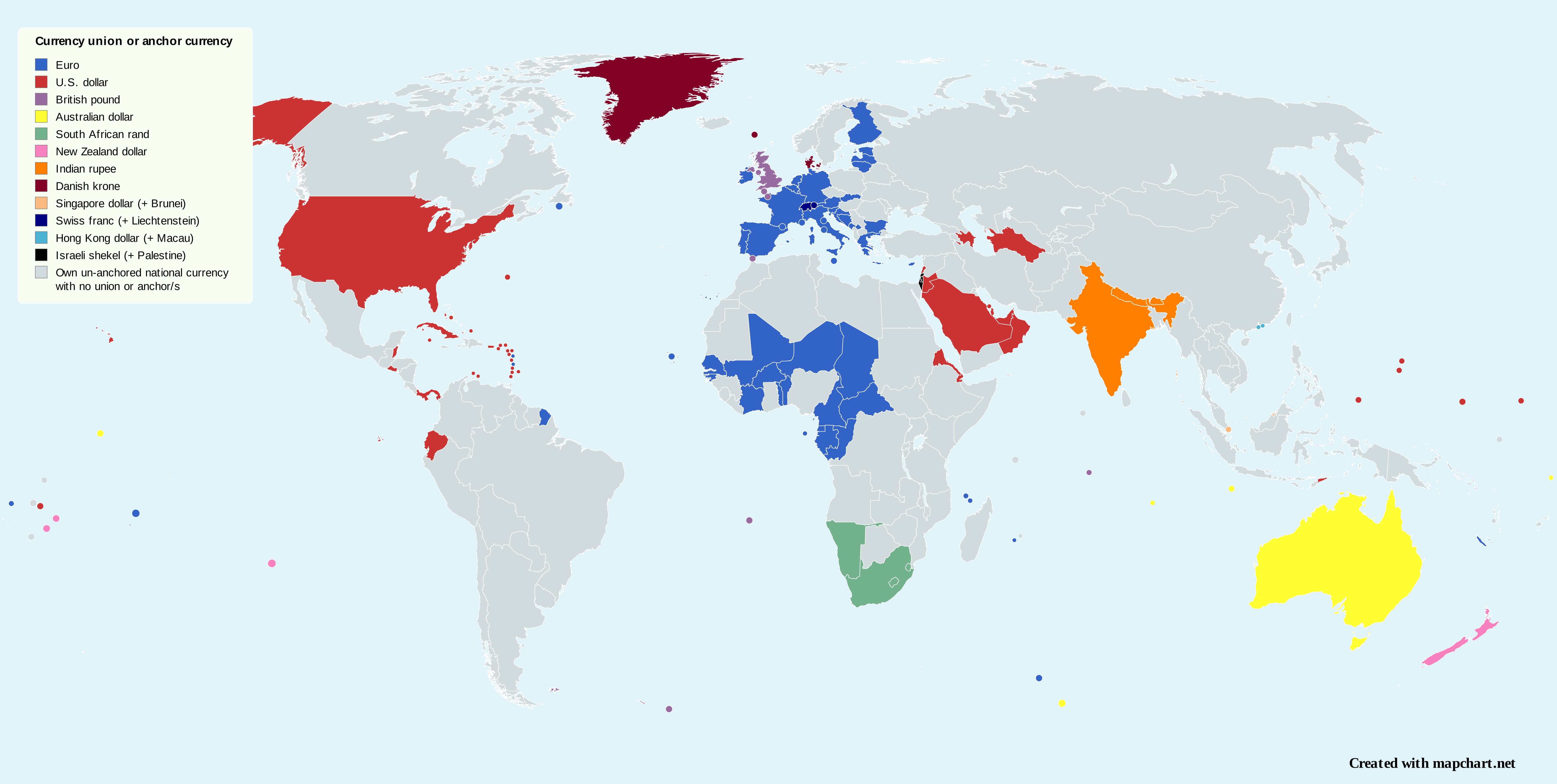

Map of Countries with Currency Unions and Anchored Currencies

Marcus Rodriguez

Historical Geography Expert

Marcus Rodriguez specializes in historical cartography and geographic data analysis. With a background in both history and geography, he brings unique...

Geographic Analysis

What This Map Shows

This map provides a visual representation of countries whose currencies are either part of a currency union or are anchored to another currency. A currency union involves multiple countries adopting a single currency for trade and economic stability, while anchoring means that a country's currency is pegged to another, often more stable, currency. Understanding these systems is crucial for grasping how economies interact on a global scale.

Deep Dive into Currency Unions and Anchored Currencies

Currency unions and anchored currencies are fascinating elements of the global economic landscape. The most well-known currency union is the Eurozone, which comprises 19 of the 27 European Union member states that have adopted the euro (€) as their common currency. This union facilitates trade and economic stability among member states, allowing for easier cross-border transactions and a unified monetary policy governed by the European Central Bank (ECB).

Interestingly, the euro is not the only example. The Eastern Caribbean Currency Union (ECCU) includes several small island nations that use the Eastern Caribbean dollar (XCD). This union helps these smaller economies leverage collective financial strength and stability.

On the other hand, many countries opt to anchor their currencies to a stronger, more stable currency to combat inflation and maintain economic stability. For instance, the Hong Kong dollar (HKD) is pegged to the US dollar (USD) at a fixed rate, which has helped keep inflation in check and has encouraged foreign investment. Similarly, several Middle Eastern countries, such as Saudi Arabia and the United Arab Emirates, peg their currencies to the US dollar, thereby stabilizing their economies in a region often marked by volatility.

Another intriguing aspect is the role of currency boards, which are institutions that hold reserves of a foreign currency to maintain the stability of the domestic currency. For example, the Bulgarian lev (BGN) is pegged to the euro through a currency board arrangement, allowing for fiscal discipline and enhancing investor confidence.

Regional Analysis

When examining the map, it’s interesting to note the geographical distribution of currency unions and pegged currencies. In Europe, the euro stands out as a powerful tool for economic integration. Countries like Germany and France benefit significantly from the euro, as it simplifies trade and investment within the region.

In Africa, the West African Economic and Monetary Union (WAEMU) features several nations using the West African CFA franc, which is pegged to the euro. This arrangement helps stabilize the economies of member countries, allowing them to focus on development while enjoying the benefits of a common currency.

In contrast, the Asia-Pacific region presents a mixed picture. Countries such as Malaysia and Indonesia maintain independent currencies but have seen fluctuations due to global economic pressures. However, they often look to the US dollar as a benchmark for their currency values, reflecting a loosely anchored currency relationship.

What’s fascinating is how different regions approach currency stability. For example, in Latin America, countries like Argentina and Venezuela have struggled with hyperinflation, leading some to consider dollarization or pegging their currencies to the USD as a potential remedy. However, such measures can be politically sensitive and economically challenging.

Significance and Impact

Understanding currency unions and anchored currencies is crucial not only for economists but for anyone interested in global affairs. These systems affect international trade, investment flows, and even geopolitical relationships. For instance, the stability provided by the euro has allowed European nations to navigate economic challenges with greater ease than countries with more volatile currencies.

As we look to the future, the trend toward regional financial integration and the use of digital currencies could reshape how we understand currency unions. Central banks are exploring digital currencies that could offer the benefits of a unified currency without the drawbacks of traditional ones. Have you noticed this shift in discussions around monetary policy?

In conclusion, the map depicting countries with currencies that are part of a currency union or anchored to another currency reveals a complex, interconnected web of economic relationships. As global challenges continue to evolve, the role of these currencies will likely become even more significant in shaping the future of international economics.

Visualization Details

- Published

- September 15, 2025

- Views

- 72

Comments

Loading comments...