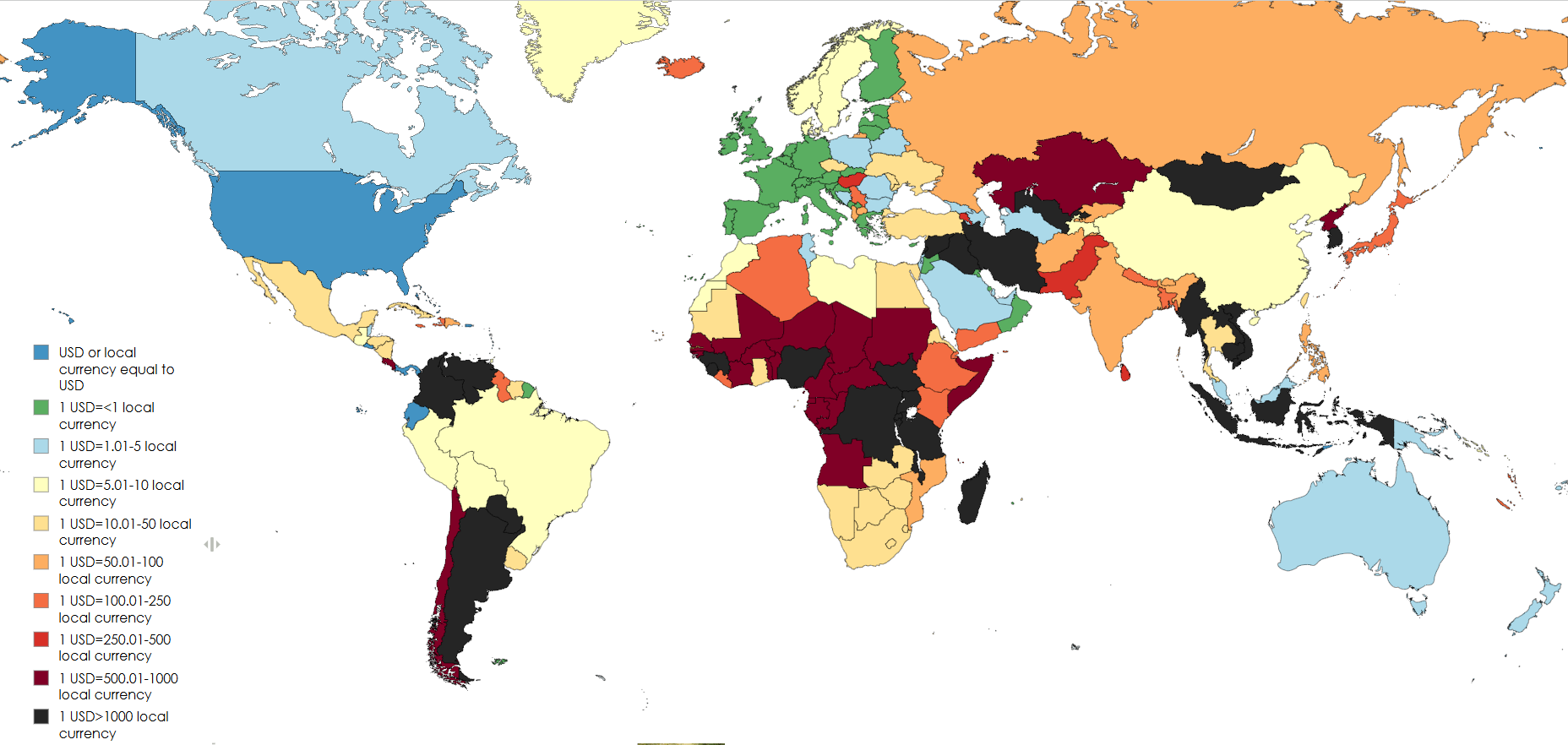

USD to Local Currency Exchange Rates Map

David Chen

Data Visualization Specialist

David Chen is an expert in transforming complex geographic datasets into compelling visual narratives. He combines his background in computer science ...

Geographic Analysis

What This Map Shows

This map provides a comprehensive view of how much 1 US dollar (USD) is worth in various local currencies around the world. It visually represents the exchange rates, allowing users to quickly grasp the relative value of the USD in different countries. Understanding these exchange rates is crucial for travelers, businesses, and anyone interested in global financial markets.

As we delve deeper, it’s important to recognize that exchange rates are not static; they fluctuate based on a range of factors including economic stability, interest rates, inflation, and geopolitical events. Let's explore the fascinating world of currency exchange, which is essential for both individuals and economies.

Deep Dive into Currency Exchange Rates

Currency exchange rates represent the value of one currency in relation to another. This process is influenced by supply and demand dynamics in the foreign exchange market, which is the largest financial market in the world. Interestingly, the USD is often considered the world's primary reserve currency, meaning it is widely held by governments and institutions as part of their foreign exchange reserves.

The strength of the dollar can impact global trade. For instance, when the USD strengthens, American goods become more expensive for foreign buyers, potentially leading to a decrease in exports. Conversely, a weaker dollar makes imports more expensive for Americans, which can lead to a rise in domestic production. This delicate balance highlights how currency values can have a ripple effect on national economies.

Exchange rates can be categorized as fixed, floating, or pegged. A fixed exchange rate is set and maintained by a country’s central bank, while a floating rate fluctuates based on market forces. Pegged rates are tied to another major currency, often the USD, providing some stability while still allowing for limited fluctuation.

It's also fascinating to explore how different countries manage their currencies. For example, countries in the Eurozone use the Euro, which has a complex relationship with the USD. The Euro usually fluctuates around a certain value to the dollar, and these fluctuations can be influenced by a variety of factors, including economic performance and political stability in member states.

Regional Analysis

When examining the exchange rates across different regions, notable variations emerge. In Europe, for instance, the Euro (EUR) often trades around 0.85 to 1.15 to the USD, depending on economic conditions. Countries like Switzerland have their own strong currency, the Swiss Franc (CHF), which often maintains a value close to 1 CHF per 1 USD during stable periods.

In Asia, countries like Japan and China have significant impacts on the global economy. The Japanese Yen (JPY) might fluctuate between 100 to 120 JPY per USD, while the Chinese Yuan (CNY) is often pegged more closely, trading around 6 to 7 CNY per USD. Interestingly, the CNY's value is influenced by government policy, making it a unique example of currency management.

In Africa, currencies can be quite volatile. The South African Rand (ZAR) has seen significant fluctuations, trading anywhere from 14 to 18 ZAR per USD over recent years. Factors like political stability, commodity prices, and economic growth all play critical roles in determining these rates. Countries such as Nigeria, with its Naira (NGN), often experience wider variances due to economic instability and inflationary pressures.

Significance and Impact

Understanding exchange rates and the value of the USD in local currencies has real-world implications for international travel, trade, and economic policy. For travelers, knowing how much local currency they can get for their dollars can help in budgeting and planning. A strong dollar can enhance purchasing power abroad, while a weak dollar may require travelers to adjust their expectations.

For businesses, particularly those involved in international trade, fluctuations in exchange rates can impact profit margins significantly. Companies must navigate these changes carefully, often employing strategies such as forward contracts to lock in rates and mitigate risk.

Moreover, exchange rates can also influence foreign investment decisions. Investors look for stable currencies when considering international opportunities. Countries with strong, stable currencies often attract more foreign direct investment, contributing to economic growth.

As we look to the future, the trend of digital currencies and cryptocurrencies is also gaining traction, potentially changing how we perceive value and exchange rates. Ever wondered how Bitcoin will affect traditional currency exchanges? The relationship between these emerging technologies and established currencies is still unfolding and will undoubtedly shape global economics in the years to come.

In summary, the value of the USD in local currencies is not merely a number; it reflects a myriad of global economic factors that can have profound impacts on individual lives and entire economies. Understanding these dynamics allows us to better navigate and appreciate our interconnected world.

Visualization Details

- Published

- September 10, 2025

- Views

- 70

Comments

Loading comments...